In February of 2001, a businessman named Humphrey Kariuki sought the protection of the courts claiming he feared the police might try to frame him by planting narcotic drugs in his premises. And so began the saga of Charterhouse Bank.

See, Mr Kariuki was a signatory to an account held by Crucial Properties Ltd at Charterhouse bank (CHB) that had received a Sh2bn ($25mn) transfer from Lichtenstein, attracting the interest of both local law enforcement and the FBI.

The FBI got involved because when Crucial Properties initially indicated that the $25mn had come from Jersey, the CBK’s fraud investigation unit assumed that it was New Jersey, USA, and alerted the FBI

Since money laundering was not an offence then, the case was dismissed.

CHB, with its HQs on the 7th floor of Longonot Place was started in 1996 by Sanjay Shah, taking over the operations of Middle East Kenya Finance and opening branches in Nairobi, Mombasa and Kisumu.

John Harun Mwau was said to own an interest.

CHB’s parent company, Ram Trust, registered offshore in the tax haven of Liechtenstein, owned Kingsway Tyres, Kingsway Motors, CHB, Village Market, Kingsway Investments, Strobe Systems, Creative Innovations, Growth Management and Michelin Tyre Expert Centre.

At CHB, some customers would routinely borrow as much as 20 times the cash they held and transact tens of millions of shillings into nameless accounts.

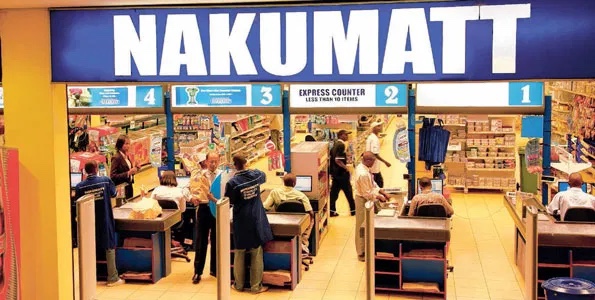

Customers included future stars: Nakumatt, Triton Petroleum, WE Tilley, Harun Mwau’s Pepe Enterprises and Tusker Mattresses.

In 2003, CHB hired an auditor from Barclays, Peter Odhiambo, who noticed several irregularities including suspicious transactions in some accounts that lacked customer identification information.

He promptly alerted KRA and the Kenya Anti-Corruption Commission.

According to a US embassy cable sent in 2004, Mr Odhiambo collected information on 85 accounts held at the bank through which, he claimed, a tax evasion scam worth US$ 573 million was being perpetrated.

But Mr Odhiambo’s whistleblowing, like that of Daniel Munyakei at CBK before him, wouldn’t be taken lying down.

Finance Minister Njeru Githae labeled him a fraud, he received death threats and the Kenya police served him with a bogus warrant.

With his life in danger, Peter Odhiambo briefed the US Embassy and was later offered asylum in the US in 2006.

He subsequently lost a case filed against the Kenya government in the States for a KRA reward/compensation as a whistleblower.

In September 2004, a fire at the bank’s offices supposedly burnt to ashes documents related to transactions executed prior to April 2004. Future audit bodies would cite the fire as the reason why the bank’s transfer details were not available.

Between 2004-06, audits by PwC, CBK and a govt Joint Legal Taskforce all found strong indications that the bank’s clients were involved in both tax evasion and money laundering. The bank was also found to be violating the Banking Act. PwC Report.

Internal auditor Peter Odhiambo: “My experience at CHB and as their internal auditor convinced me that the Bank was not established to carry out legitimate banking business. In view of this, I became suspicious of over 70% of the total number of accounts.”

On 21st June 2006, the then shadow Finance Minister in the official opposition to the Kenya government, Billow Kerrow, tabled before Parliament a leaked report claiming that CHB had assisted Nakumatt to evade taxes estimated at Sh18bn over a six year period.

Accounts held by WE Tilley, Tusker Mattresses, Creative Innovations, Italians Paolo Sattanino and Francesco Tramontano indicated suspicious balances and transactions, with directors at Tusker Mattresses holding 75 different accounts at the bank.

In June 2006, CBK placed CHB under statutory management. Despite all this, in 2010, a Parliamentary committee cleared CHB of any wrongdoing and suggested it be reopened. CBK Governor Andrew Mullei’s zeal in dealing with CHB became his Achilles Heel.

In October 2010, Finance Minister, Uhuru Kenyatta said the ministry had no report or evidence from any government agency on the bank’s alleged misdeeds and that he had only seen what was published in newspapers. He recommended re-opening CHB.

In a dossier to the Kenya Anti-Corruption Commission (KACC) director Patrick Lumumba, US Ambassador Michael Ranneberger claimed Sh60bn had been lost through financial malpractices with Sh20bn lost in tax revenues. Rannenberger was castigated by MPs.

Charterhouse Bank never re-opened and as recently as 2016, various groups were lobbying for its reopening.

The bank remains closed with over Sh3bn in customer deposits seemingly lost in the confusion.

Fast forward to the present day and key CHB customers have crafted their own illustrious, headline-grabbing stories.

In 2011, the US sanctioned Harun Mwau under the Kingpin Act (for drug lords) and froze all his assets in the United States.

WE Tilley, a company that claimed to be in the fish(y) processing business was heavily involved in the collapse of Imperial Bank. Imperial Bank’s receiver manager filed a lawsuit against Tilley and 12 other companies.

Triton Petroleum’s Yagnesh Devani went on to pull off the country’s biggest oil heist, taking off with Sh7.6bn worth of oil from KPC. After 10 yrs on the run, Devani recently lost an extradition case and should be shipping back to Kenya post-Corona.

Even with the murder of its internal auditor Nakumatt collapsed.

“Nakumatt was no ordinary company. It more or less operated as one of the main cogs of a complex money laundering syndicate that had operated in the country for more than 30 years.”

Humphrey Kariuki, he of the Sh2bn transfer back in 2001, is now on a first name basis with almost everyone at KRA’s Times Tower HQs, and even the courts seem to be paying him regular courtesy visits every now and then.

Humphrey Kariuki Ndegwa hit the headlines when the Director of Public Prosecution (DPP) said that he was a wanted man. Kariuki, though, is not your ordinary billionaire. He maintains a low profile and commands a business trajectory that has left many confounded. In early 2019, the public was ushered into his reclusive life following a bust at one of his businesses.

The burst took place at the Africa Spirits Limited company where estimated 21 million counterfeit excise stamps and 312,000 litres of illicit products were discovered. These items were all worth billions of money. Kariuki built this brewery in 2002. “I’m proud to say that Africa Spirits Limited is the most successful indigenous alcoholic beverage company in Kenya today,” he is reported as saying two years ago.

The opening of this lid on Kariuki’s tax cheating revealed the dealings of a businessman who has been accumulating millions, if not billions of money through tax evasion (His case in court was later dismissed over the prosecution’s failure to table witnesses).

According to a report in the Daily Nation, Kariuki’s Africa Spirits Limited is just one entity in his multi-billion empire. Africa Spirits, which is popularly known for alcoholic drinks such as the Bluemoon Vodka, is only a small part of Mr Kariuki’s multibillion empire. His business conglomerate includes The Hub – a premier shopping mall located in the beautiful leafy suburbs of Karen in Nairobi; Dalbit Petroleum, one of the largest oil distributors in East and Southern Africa, and Great Lakes Africa Energy, a U.K-based company that is a developer and operator of power projects in Southern Africa. Kariuki is also the owner of the 5-star Fairmont Mount Kenya Safari Club, and the neighboring Mount Kenya Wildlife Conservancy and Animal Orphanage.

“Born 61 years ago in Nyeri in a family of 10, Mr Kariuki studied at Nairobi School and Kagumo High School before joining Central Bank of Kenya when he was only 19 as a clerk,” says the report. Kariuki himself told Forbes that he started at the bottom of the ladder. “I always tell people that in life you need to start from the bottom; the only place where you start at the top is when you’re digging a well. So I started as a clerk, and then went on to work in various other departments in the bank,” he told Forbes magazine in 2017.

He claims that he made some “decent income” at Central Bank and then ventured into the business world by importing cars. Allegedly, he starting off with a car owned by his UK-based elder sister which he had shipped to Nairobi. “I was able to sell (the car) at double the price my sister was asking for. I gave my sister her money and kept the rest for myself. I was amazed, and I wondered: ‘Is this how easy it is to make money?’”

The report further also said that while still in his late 20s, “Kariuki ventured into wines and spirits distributorship through Wines of the World Limited as the distributor for Jack Daniels, Bacardi and the Edrington Group, whose premium brands include The Macallan, The Famous Grouse, and Brugal rum.”

The Nation further said that in the 80s, Kariuki set up the Green Corner Restaurant at Nairobi’s Tumaini House, behind Kencom House. “We made the best hamburgers, steaks, and samosas among other things. For years, Green Corner was the place where professionals who worked in Nairobi converged for their lunch and business meetings,” he said in the Forbes interview.

At the indoor parking of Tumaini House, Kariuki’s car business blossomed. Apparently, at Kariuki’s you could find the latest state-of-the-art European motor vehicle models such as BMWs, VWs, Mercedes and Range Rovers.

“At any given time, there would be an average of five vehicles with foreign registration number plates. After a few days, the vehicles would be replaced with another different set — meaning he was in a booming business. That he would be able to import such high-end cars at a time when the foreign exchange regime was prohibitive meant a lot on the kind of business strings that he managed to pull or, perhaps, pointed to his acumen as an astute businessman. But again, Mr Kariuki had previously worked at the Foreign Exchange Department of CBK which was approving foreign currency for businessmen intending to import goods,” reported the Daily Nation.

Not much about Humphrey Kariuki family is known to the public. The self-made tycoon seems to have mastered the art of secrecy.

Unlike most multi-millionaires who love to parade their families or involve them in activities and thus exposing them to the limelight, Mr. Kariuki has managed to keep his family away from the public.

Therefore, no information is available about Humphrey Kariuki’s son. However, the name of his wife Stella Nasike came out when the pair were about to lose their Cypriot passports.

According to an article published by Daily Nation, the celebrated tycoon and his lovely wife were about to lose their Cypriot passports because of the strict citizenship rules introduced by the European tax haven.

Few Kenyans own jets, and Humphrey Kariuki wealth allows him to be one of them. As an international businessman who boasts of numerous businesses in and outside Kenya, owning a jet to him is not difficult.

There's no story that cannot be told. We cover the stories that others don't want to be told, we bring you all the news you need. If you have tips, exposes or any story you need to be told bluntly and all queries write to us [email protected] also find us on Telegram