The story of the rise of Martin Muhoho as the Unaitas Chief Executive Officer begins somewhere in mid-2018. In a board meeting, the directors had decided to terminate the services of the then CEO, Tony Mwangi. According to the Board of Directors, Tony had reached his performance plateau and there was a need to ensure new blood was brought in.

Tony Mwangi resigned in October of the same year, and Martin Muhoho was appointed the ag, CEO which caught many people by surprise but not to insiders who knew what was going on in the Sacco. According to insiders Mr. Muhoho had been canvassing for the position of CEO from the members of the board. It is alleged that he led to the dismissal of Chief managers who he felt were a threat to him achieving his goals. Insiders say he used his position as the Chief Manager Risk and Compliance to manipulate the board of directors to dismiss Mr. Harun Mwirigi, Chief Manager Commercial, Mr. Guantai Kinyua as Chief Manager Business Development and Mr. Nyaga Thagichu, Chief Manager Human Resource to lessen the competition for the coveted CEO position.

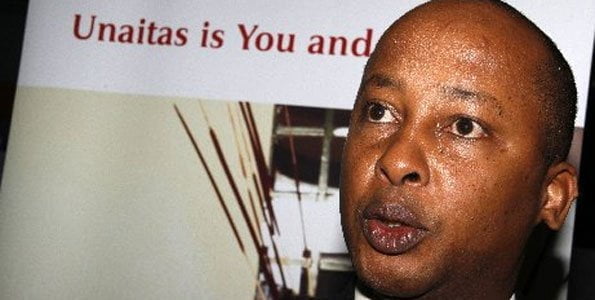

Former Unaitas CEO Tonny Mwangi

Mr. Muhoho’s determination to remove the alleged threats to his reign at the giant Sacco did not stop with his appointment, just months into his new position, he went on a firing spree. The first casualties were his friends at the Sacco. These included; Stanley Kanyuiro, Head of Branch Banking and James Gichohi, Head of Finance. Insiders believe that the sacking of his friends was to guard his image and ambitions at the Sacco and the friends were a threat since they knew the real Muhoho.

Mr Muhoho’s cleaning continued, a few months later when he fired the Chief Manager of Finance, Rosemary Karanja and Chief Manager of Internal Audit, Edwin Njeru. Rosemary was replaced, without any competitive process by Muhoho’s neighbour in his village in Gatundu, Fidelis Wanjihia. Mr. Njeru was replaced by Peter Kamau, the then Head of Internal Audit. Mr. Kamau would be replaced weeks later after raising some audit queries. Mr. Kamau was replaced by finance officer Alice Kimani.

The Board of Directors started raising issues on these exits, to calm the directors Mr. Muhoho recommended the increase of their sitting allowances from Kes 55,000 to Kes 80,000 per sitting. This calmed the situation and opened the real reign of Mr. Muhoho.

Mr. Muhoho has since been accused of fraudulently acquiring wealth from the Sacco. It is alleged in 2020 when Covid 19 began he withdrew 10 Million shillings. The purpose of the funds was to help fight covid 19. However, insiders say this entire amount was personally used by Mr. Muhoho and the accountant Mr. Alfred Ngure helped him cover it up by raising fictitious invoices and expenses. In return, Mr. Ngure was rewarded, and as ridiculous as it may sound, with an iPhone.

Mr. Muhoho has continued to take funds illegally from the Sacco through proxies that are given contracts at exaggerated prices. Some of the contracts noted include the provision of a biometric system by AO Technology. The system cost the Sacco in upwards of Kes 50 Million. The system failed terribly and has never been used. Another company that shares the same directors as AO technology is Software people. The company has been tasked with providing mobile services by the Sacco. The company supplies them with bulk SMS. However, the SMS are priced at almost ten times the current market rates.

Software people are also tasked with providing a system that is used by their staff that are known as Independent Staff Agents. These are tellers at most of the Sacco Branches. They have no direct access to the core banking system and they usually use a different system with limited capabilities. This is the reason why some tellers send you to the next counter if you withdraw above Kes 100,000. These tellers do almost the same job as the Unaitas tellers but are poorly paid as most of the money is paid to Software people. The company also charges the Sacco for tellers to use its system; hence the Sacco incurs further costs. Software people charge the Sacco Ksh 14,000 per agent per month. There are about 30 agents hence; the proxies get over 400,000 from the Sacco for doing nothing at all.

The other company that Mr. Muhoho uses to fleece the Sacco is Nam builders. This company is allocated all contracts to upgrade branches at exorbitant fees. One of these cases was the laying down of cabros at one of the branches in Muranga region. A parking for 3 cars was charged in excess of 2 Million shillings. Others include the renovation of the Gikomba branch that was paid for in excess of 25 Million shillings. Most of these funds get back to Mr. Muhoho via cash payments.

The Sacco is regulated by Sasra. The regulator auditors once raised an issue with the management. However, the CEO was able to sort them out. One of the most notable cases was whereby he employed a newly Graduated daughter of one of the lead auditors of Sasra as a procurement assistant. (Story for another day)

Sacco Societies Regulatory authority (SASRA) Ag. Chief Executive Officer Peter Njuguna is among the people under Unaitas Boss Martin Muhoho Payroll

Mr. Muhoho has further used his position to employ his relatives, friends and girlfriends at the organization. The notable Muhoho relatives include; Mr. Simon, his nephew as a credit administrator, his nephew Philip as a relationship officer, and his niece, a procurement assistant. All these have been hired without any competitive process being followed.

To silence the board, the CEO has ensured that all recruitment processes that are done, only relatives to the board members are employed. A factor that is costing the Sacco heavily of its employees. This has led to mass resignations with the most current being from the IT department, which has resulted in system failure being experienced on daily basis.

In the recent past, Mr. Muhoho promoted his girlfriend Brenda Kiende to the position of the Chief Manager of Internal Audit. Ms Brenda has no accounting background; she has a degree in marketing. This goes against all regulatory frameworks that require the Chief Internal Auditor to be a certified Accountant. The reason for this was to ensure no one would question him as he fleeces the Sacco further. Ms Brenda has previously failed for positions of branch managers, through competitive interviews, how she qualified for the second highest position at the Sacco remains a mystery to both friends and foes.

Mr. Muhoho recently also promoted his young girlfriend, Ann Wamoro to the position of Head of Human Resources. Ms Wamoro has zero training in HR as she was previously a procurement assistant. She replaced an HR officer who had a master’s in HR as well as HR certification.

Mr Muhoho has appointed the head of insurance as the Chief Manager Business Development. Mr. Ken Karinga. Mr. Karinga is the perfect definition of incompetence, the man dwells on Utopia and the ideal world, but he cannot even sell water to a man dying of thirst. That’s the man Mr. Muhoho has entrusted

to grow the loan business. The position was held by a highly qualified man, Mr. Simon Gachuru, who was dismissed on raising an issue with the way Mr Muhoho was handling the Sacco. Mr. Muhoho has ensured that no competent person is left as a head of any department to ensure his decisions are never questioned.

Mr. Muhoho has been known to prey on his staff members. A casing point was him impregnating a sales rep, one Faith Moraa. He later married her and they have two children.

The other staff members with who Mr. Muhoho is accused of having sexual relationship include; Mary Mwangi, Head of Credit Administration, and Grace Kimani, Head of Procurement.

Many people are asking where the Board of Directors are when Mr. Muhoho is leading the Sacco down the drain. The simple truth is, the entire board is made of mostly school dropouts, who cannot even understand what a balance sheet is. A casing point is the chairman Mr. James Kinoro, who dropped out of primary school. They take Muhohos word as the gospel truth. Further the CEO has increased their seating allowance to as high as 180,000 per seating. He has also ensured that during recruitment the directors are allowed to bring their relatives to be employed at higher salaries than existing staff doing the same job. Mr. Muhoho ensured competent board members were removed by changing the rules of being a director in the middle of an election year. This saw Mr. Gabriel Mugo axed as a board member and the chairman of the audit committee. Former Chairman Mr. Ngaai was also removed as the chairman of the board.

Unaitas chairman Mr. James Kinoro who dropped out of primary school.

For the last five years since Mr. Muhoho was appointed as the CEO, no single advertisement was placed for any position, but the organization has had more than 80 staff members hired. 70% of them are from Mr. Muhoho and the 30% are from his board members.

In the recent months Mr. Muhoho has been approaching ex-staff members who have sued the Sacco and offering them out-of-court settlements and in return getting kickbacks. This is done through Mutua Waweru advocates, the only law firm the Sacco uses in the courts, despite having other pre-qualified law firms. In the last few months, the Sacco has made a settlement of close to 20 million shillings, through the CEO’s directive.

In 2022 January staff members at the Sacco eagerly and earnestly waited for a pay rise, at least, an inflation adjustment as was the norm in previous years. The CEO, instead, at the end of January sent the staff members an email indicating that no pay rise would be done. The Sacco had performed well despite the covid pandemic, or was it? The truth was that the CEO had misled the Board, with the help of the external auditors PKF, through Asif Chaudhry, a leading partner at the audit firm, that the Sacco had made over 600 Million in profit, but there was one problem, there was no money to show for it. In account, you can cook books, but you cannot cook cash. The CEO had cooked the books but couldn’t cook the actual Money. The Sacco was almost broke; the liquidity ratios were on the roof. The CEO approached Oiko who granted the Sacco a loan of One billion shillings to sort the liquidity issue.

Despite the Sacco having all these challenges, the CEO found it okay and reasonable to increase the salaries of some of the staff members. The CEO increased his salary from 950,000 to 1.3 Million shillings.

He further increased the salary of Chief Managers from 450,000 to 640,000 shillings. His girlfriend Ann Wamoro got an increase from 80,000 to 150,000 shillings as a procurement assistant. With her appointment as Head of HR, her salary will double again to 300,000 shillings.

The Sacco recently acquired land at the northern bypass. The land was priced at shillings 120 Million, however, the Unaitas CEO negotiated with the owner upwards to shillings 150 Million. The balance going to his pockets.

The Sacco SGM was held on 30.09.2022. One of the items that were approved was the budget for the Sacco Head Office. One thing the overly excited delegates did not know was the grand scheme the CEO has in store for himself. The over 0.5 billion budget for the HQ is where Mr Muhoho bet his golden goose. He is planning to fleece the Sacco by over 200 Million and then resign.

The Sacco prides itself with being the tea farmers’ choice for financial needs. However this year the tea bonus was paid 3 and half months earlier. Mr. Muhoho ensured the farmers were charged interest for the months to November 2022. In total, the farmers were robbed of over 200 million shillings.

Unaitas Branch

Mr. Muhoho has previously been reported to KRA, for tax evasion, but has always found a way to sort them and stay out of trouble.

This bias has seen staff members resigning in droves. The staffs are tired of the pure discrimination meted on them by Mr. Muhoho with the support of the board.

The Sacco is slowly but surely bleeding to its demise. Unless and until the CEO is removed from the helm of the Sacco, the end is gradually approaching for the once giant Sacco.

For Unaitas Sacco to thrive, SASRA and the Director of Cooperatives MUST move WITH SPEED AND REMOVE THE ENTIRE UNAITAS BOARD AND THE CEO. If this is not done, the Sacco will go down with the member’s Funds, which are nearly 12 Billion shillings and leave Martin Muhoho and James Kinoro smiling all the way to the looted funds.

There's no story that cannot be told. We cover the stories that others don't want to be told, we bring you all the news you need. If you have tips, exposes or any story you need to be told bluntly and all queries write to us [email protected] also find us on Telegram