Chinese Companies In Kenya Evading Tax On The Rise. From Transsion Holdings, the Chinese-based smartphone maker behind popular brands; TECNO, Infinix, itel and smart accessories brand oraimo currently locked in serious claims of massive tax evasion, smuggling of undocumented Chinese workers and serious labour abuses in Kenya. Transsion is facing Sh400 billion tax evasion allegation.

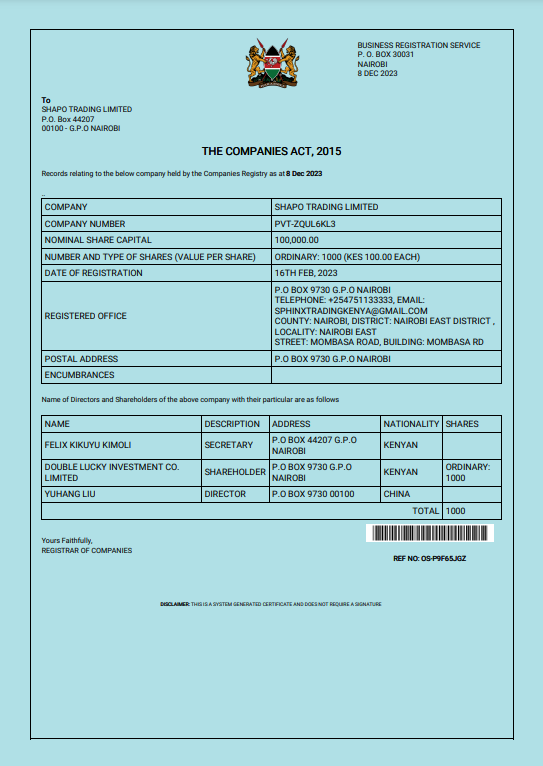

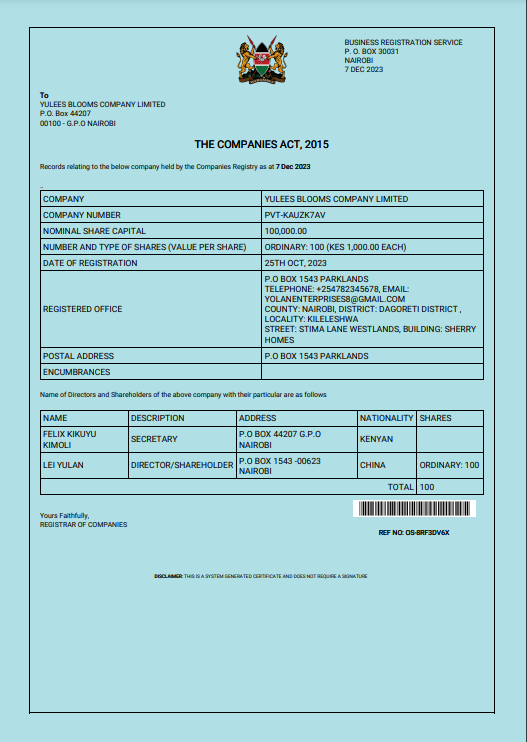

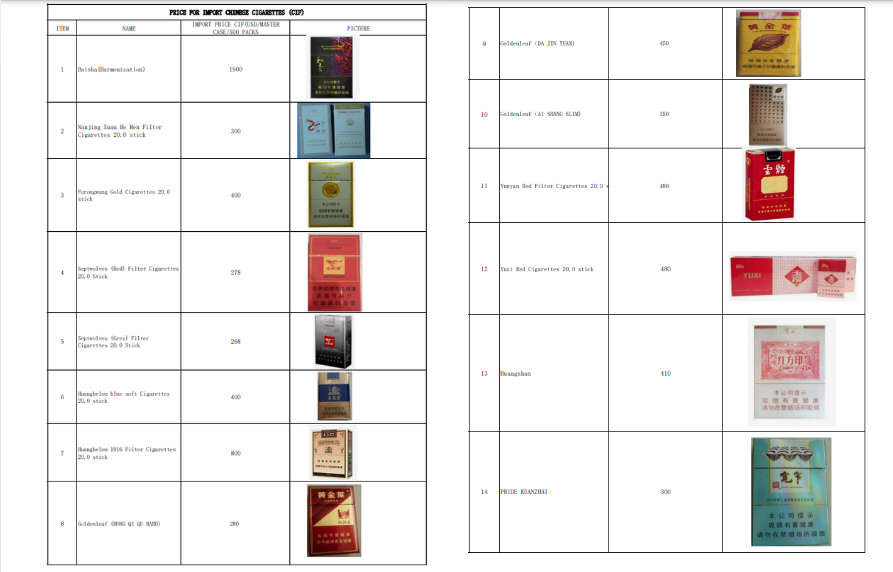

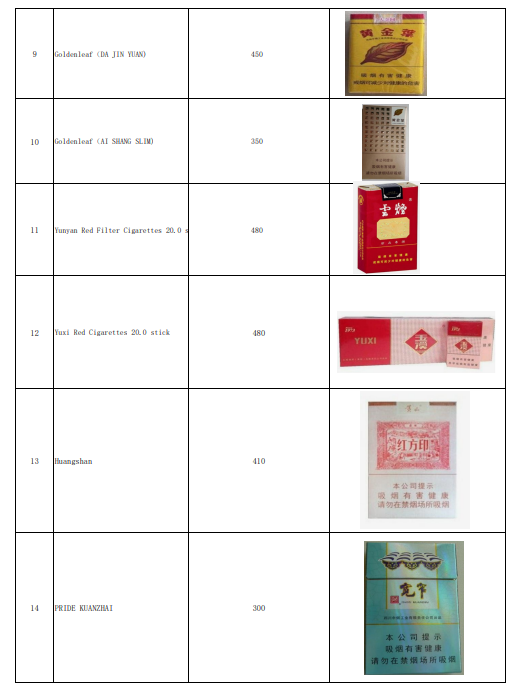

Two Chinese-linked companies are under investigation over allegations of tax evasion related to cigarette importation. The companies are suspected of importing numerous cartons of cigarettes and evading tax obligations. Both the Kenya Revenue Authority and the Directorate of Criminal Investigations are probing how Shapo Trading Limited and Yulees Blooms Company managed to import these cigarettes without an Electronic Tax Register (ETR).

Officials indicate they are acting on intelligence that the Chinese companies imported cigarettes into Kenya without paying taxes, with the cigarette packets lacking excise duty stamps.

“The teams are searching for about 200 cartons missing from the company warehouses in the city. This is part of the probe into the claims,” said an official involved in the investigation.

Further information suggests that approximately 40 cartons may have been smuggled to neighboring countries for sale. Intelligence reports indicate that certain government officials might be complicit in facilitating the smuggling and tax evasion. “We will know more soon. A team is on the ground to establish all that,” added a source.

This practice, officials noted, is harming the local tobacco industry and impacting the welfare of local farmers.

Both companies, domiciled in Kilimani and along Mombasa Road, declined to comment immediately, with one representative stating that they are law-abiding citizens.

China, a heavy consumer of cigarettes, reportedly imports their brands for both consumption and sale in Kenya, with this evasion allegedly denying the country millions in tax revenue.

This comes amid reports that KRA registered a revenue shortfall in October, with significant declines in collections from domestic VAT, PAYE, and Excise Duty.

Import Duty, VAT, and the Import Declaration Fee (IDF) collectively fell short by Ksh 2.9 billion, attributed to reduced non-oil imports and the impact of increased tax cuts.

Excise Duty on money transfers declined by Ksh 728 million, reflecting lower banking transaction values. Domestic Excise Duty decreased by Ksh 573 million due to reduced production in bottled water, beer, and tobacco.

PAYE remittances dropped by Ksh 1.2 billion, as large taxpayers offset liabilities using tax refunds, and Domestic VAT saw a 26.3% decline, leading to a Ksh 2.3 billion deficit.

However, the competency of KRA to do its job is in limbo as seen in the Transsion -Tecno case where the officials resorted to receiving kickbacks as Private tax to give a blind eye to these Chinese businesses evading tax amongst other malpractices.

There's no story that cannot be told. We cover the stories that others don't want to be told, we bring you all the news you need. If you have tips, exposes or any story you need to be told bluntly and all queries write to us [email protected] also find us on Telegram