Detectives are piecing together details of how Mathira MP Rigathi Gachagua registered 49 companies which he used to trade with various government agencies in an intricate web that saw him win tenders worth more than Sh12 billion.

In what detectives now claim to be “a well-knit complex scheme of money laundering”, Gachagua opened at least 33 bank accounts through which payments were made and sometimes money hastily withdrawn.

Some of the companies that received hundreds of millions of shillings from the government, were either owned by Gachagua himself and his family members, his close friends and relatives or proxies.

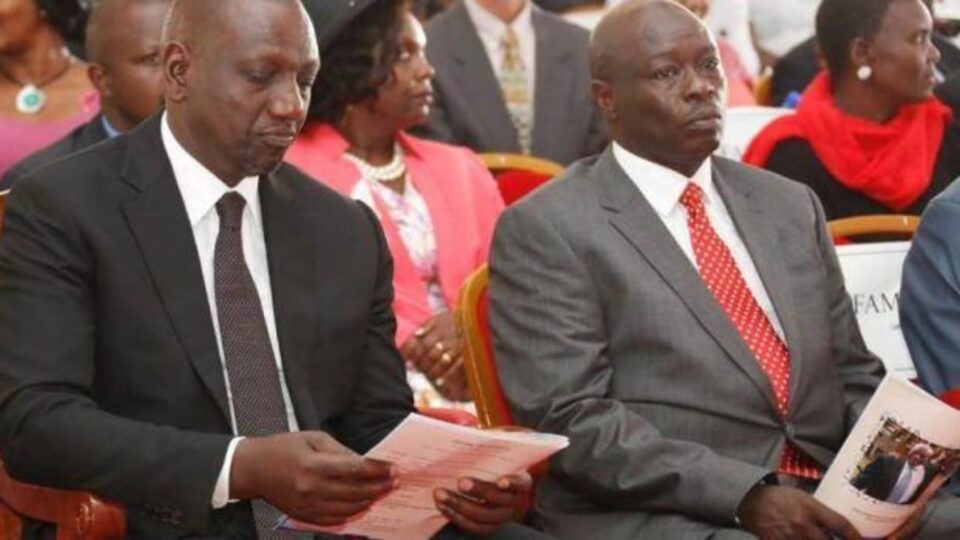

As if following in the footsteps of prominent businessmen across the globe, who have been implicated in money laundering schemes and fraud related cases, Gachagua, a close ally of Deputy President William Ruto, used multiple bank accounts to receive payments from various entities before the amounts could be transferred to other firms that he controlled.

Some of the companies had youths as directors, who after receiving payments for tenders reserved for the youth and women would transfer the money directly to accounts of companies owned by the MP.

Detectives say that during interrogation and statement recording, the youth who were used as decoys in the ownership of the companies appeared clueless, naïve and “completely had no idea of what businesses the companies were doing”.

Interestingly, most of the money transfers ended up in a company known as Wamunyoro Investments Limited, that is jointly owned by Gachagua and his wife, Pastor Dorcas Wanjiku.

Road construction works

“It is a complex web that has taken us more than two years to unravel,” said one of the investigators.

Questions have emerged how some of the companies that won tenders, particularly road construction works in Nyeri county, remitted part of the payments to companies either owned by Gachagua or those associated with him without raising eyebrows.

One of the companies, Stecol Corporation, is said to have wired Sh15 million to Skytop Agencies as Endrem Agencies remitted Sh34 million to Machine Centre Ltd.

Machine Centre Ltd is linked to William Wahome, the board chairman of Mathira NG-CDF, and Elizabeth Wachera. Machine Centre and Wamunyoro Investments have a Joint Venture savings account at Equity Bank.

Documents from the Serious Crimes Unit that has been investigating the matter since last year indicate that about 11 companies associated with the MP received a total of Sh590, 623,107 from the national and county governments without going through the mandatory Integrated Financial Management Information System (IFMIS).

Strong networks

Leading the pack are Encater Diagnostics Ltd that received Sh123,175,000 from county governments and Technical Supplies and Services (K) which got Sh220, 877, 180.85 from the national government.

Other companies include Skytop Agencies that received Sh20, 674, 333.60 from the national government and Sh2,051,307.15 from counties; Riang International Group Limited Sh 7,033,595.75; Machine Centre Ltd Sh67,315,622; Jenne Enterprises Sh79,208,297.40; Rapid Medical Supplies Ltd Sh9,482,758.60; Encarter and Rapid Group Ltd Sh3,037,720; Asoma Enterprises Sh8,452,590.90 and Wamunyoro Investments Ltd Sh22, 068,149.

Contacted yesterday, Gachagua put on a brave face and dared both the Directorate of Criminal Investigations (DCI) and the Ethics and Anti-Corruption Commission (EACC) to meet him in court.

“I am not ready to fight the DCI George Kinoti through the media, but let him prepare himself for a battle royale in court. He can combine his efforts with the EACC and come together because I am ready for the war,” Gachagua, who said he was busy campaigning for the United Democratic Alliance (UDA candidate in the upcoming Kiambaa by-election said.

The first-term MP, believed to have perfected his business networks from 2013 when his late brother Nderitu Gachagua was elected Nyeri Governor, seems to have created strong links within the government that enabled him to receive more than Sh2.5 billion between 2015 and 2017.

For instance, during the period, the MP was paid more than Sh668 million from the National Irrigation Board (NIB); Sh502 million from the Kenya Informal Settlement Improvement Project; Sh339 million from the Ministry of Lands and Housing; and Sh195 million from the Directorate of Personnel Management MLG Kenya Municipal Programme.

Other payments included Sh171 million from the State Department for Water; Sh143 million (Lake Victoria Environment Management Project II); Sh136 million (State Department for Irrigation); and Sh105 million from the Ministry of Environment.

According to investigators, Gachagua also did roaring business with other state agencies such as Athi Water Services Board Sh58 million; State Department for Interior Sh43 million; KERRA Nyeri Sh32 million; Ministry of Health Sh32 million; Karatina University Sh24 million; Ministry of Defence Sh23 million; Lake Victoria Water Services Board Sh18 million; State Department for Gender Sh15 million; Tana Athi River Development Sh12 million; State Department for Special Programmes Sh11, among others.

Gachagua has been embroiled in a court battle with the Assets Recovery Agency (ARA) after the latter flagged Sh12.5 billion deposited in his various bank accounts as proceeds of crime.

Multiple entries

In documents filed in court, ARA argued that Gachagua had received more than Sh12.5 billion through three accounts in Rafiki Finance Bank, in seven years, payments that the agency believed were proceeds of corruption.

According to the agency, Gachagua had made a total of Sh7.3 billion withdrawals through bank statements in accounts that were left with a balance of Sh200 million.

The agency told the court that there were no bank statements to show how the balance of Sh5.1 billion was withdrawn from the fixed deposit account in what it termed “a complex scheme of money laundering”.

ARA tabled in court documents indicating that one of Gachagua’s savings accounts had a balance of Sh773, 228 after receiving Sh5.8 billion and a fixed deposit account was left with Sh35 million after receiving about Sh877 million.

A second fixed account had received Sh5.87 billion of which Sh705.1 million had been withdrawn, but with a Sh165 million balance, leaving an unexplained Sh5.1 billion.

But in his replying affidavit, the MP had told the court that he had moved Sh200 million back and forth in his three accounts at Rafiki Micro Finance Bank over a period of seven years, giving the impression that the multiple entries were new deposits.

The MP questioned the records captured by ARA, arguing that the agency failed to appreciate how transaction accounts at Rafiki Micro Finance Bank were operated, and insisted that the Sh200 million had been the same fixed revolving fund rotating between three accounts for seven consecutive years. According to Gachagua, upon maturing… quarterly, the principal amount plus interest earned are rolled back to the savings accounts at his request.

ARA had investigated a total of 33 bank accounts that the MP dealt with or companies associated with him, including Wamunyoro Investments Ltd, Crystal Kenya Ltd, Machine Centre, Technical Supplies and Services Ltd, Skytop Agencies and Specific Supplies Ltd.

Other entities through which detectives believe Gachagua transacted his business with the government include The Olive Garden Hotel that is owned by Kenneth Gachagua (his nephew and son of the late Nyeri governor), Rigathi Gachagua, the late Nderitu Gachagua, his widow Margaret Nyokabi Nderitu and Susan Kirigo Nderitu.

The four also owned Vipingo Beach Resort, Hard Rock Quaries , Queensgate Serviced Apartments Spa and Resort, Triple Eight Construction Kenya and Pioneer Medical (K) Ltd).

The MP and his wife jointly own Karandi Farm Ltd, Heartland Supplies Ltd, Wamunyoro Ltd, Delta Merchants Ltd, Biomet (K) Ltd, Vetland Agencies Ltd, Calvary Creed International, Ridor Furniture Mart, Ridor Properties, and Specific Supplies (K) Ltd,

Almost all the 49 companies under probe are spread across Nairobi and Nyeri. Most of them are housed in various buildings on Ngong , Lang’ata and State House roads in the city.

There's no story that cannot be told. We cover the stories that others don't want to be told, we bring you all the news you need. If you have tips, exposes or any story you need to be told bluntly and all queries write to us [email protected] also find us on Telegram