An excerpt from prolific Nigerian investigative journalist @DavidHundeyin’s book “#BreakingPoint” mentions how Assets Recovery Agency (ARA) kept surveillance of suspicious financial activities by fintech company ‘Flutterwave’ and reveals how millions of dollars were shuffled through poorly documented transactions, ultimately leading to a year-long negotiation where the ARA used account restrictions as leverage rather than pushing for prosecution, culminating in the case being dropped in July 2023 despite media resistance to bribery and pressure.

Nigerian tax expert and legal practitioner Alexander Ezenagu was strongly implicated in fraudulent activities at Flutterwave and named multiple times in the ARA lawsuit.

On one hand, the case against Flutterwave is believed to have been manufactured by the then-ruling administration to thwart Ruto’s Presidential bid due to his proximity to the company.

Many had anticipated that the case would be withdrawn following William Ruto’s successful bid for the presidency due to his perceived ties to Flutterwave.

President Ruto is the father-in-law of Alexander Ezenagu, husband to the President’s daughter, June Ruto.

There was talk of Flutterwave’s alleged role in financing President Ruto’s bid for office.

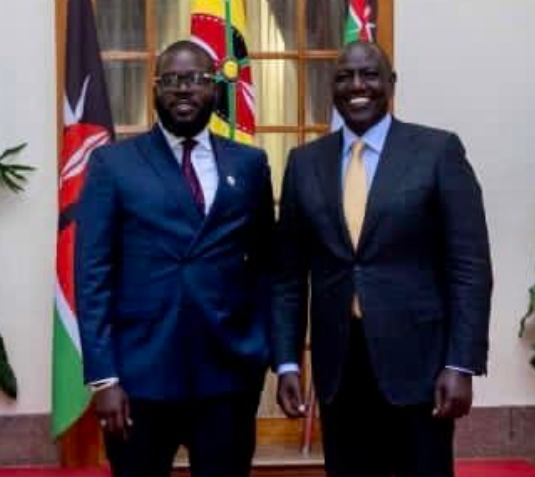

During the 2022 election campaign period, Ruto was often seen in close proximity to Flutterwave’s co-founder/CEO Olugbenga Agboola.

Despite Flutterwave’s press release claiming they had been “cleared of wrongdoing” High Court judge Nixon Sifuna’s judgment made it clear that the ARA’s withdrawal was due to dishonesty, openly accusing the ARA officials of bribery, racketeering, and corruption.

Flutterwave’s payment trails were anything but clear and simple.

Instead of a clearly identified payment for a clearly identified good or service from a recognised entity to another entity, what the ARA noticed was that millions of dollars were being rapidly passed through Kenya’s financial system through a maze of corporate bank accounts belonging to dozens of businesses with no clearly defined reasons for these financial flows.

These were purported payments for services rendered and the documentation provided included Service Level Agreements (SLAs) purporting to back these up.

On close examination, many of these SLAs turned out to be poorly edited templates, often direct copies of each other.

That was the first red flag from a regulatory point of view.

Who makes multiple business payments for millions of dollars to multiple accounts belonging to multiple businesses that are also paying millions of dollars to each other, and all this is based off of a few template SLAs which they hurriedly edited, in some cases with spelling mistakes?

A lot of this money appeared to originate from Nigeria, but what was its true source?

What was in fact happening was not a series of business transactions but one of the most egregious instances of ‘layering’ ever caught by an African regulator.

Layering is the process of shuffling money across multiple accounts, banks and financial institutions so as to obfuscate the true source of the funds by adding layers of artificial legitimacy to funds.

The idea is that if the money is shuffled around sufficiently, whatever underpaid compliance/regulatory staff member whose job it is to spot suspicious transfers will not be able to find the true source of the funds due to the dizzyingly complex maze of transfers that make it extremely difficult to track and locate.

Layering is extremely difficult for a financial regulator to defeat because short of physically shutting down the infrastructure of modern electronic banking, which permits vast volumes and amounts of transfers to take place almost instantaneously, there are only so many eyeballs and so much computing power to keep track of suspicious financial flows.

But the real juice of the story here is that ARA’s freeze on Flutterwave’s accounts was never to push through a proper prosecution, ultimately resulting in forfeiture of clearly laundered funds by Flutterwave to the Kenyan government.

The clever folks at the ARA knew that if they did that, the funds would go into the Treasury and be lost to both Flutterwave and the ARA.

It was much better to use the account restrictions as a bargaining chip to force the “Nigerian boys” to the negotiation table.

And that is exactly how it panned out.

There was more than enough documented evidence available for the prosecutors to obtain a criminal conviction for money laundering, and ultimately forfeiture of the seized funds but that was never the intention of the folks at the ARA.

The whole thing was just manufactured drama for the benefit of the ARA’s bargaining position.

When the negotiations were not going so well, a little tidbit of information from the court files would be leaked to journalists at the Business Daily who would in turn, publish the story, which would receive widespread attention and then Wendy the Flutterwave PR lady would start buzzing around him trying to put out the latest fire whose sources she could not even begin to understand.

Former Nation Media Group journalist Adonijah Ndege resigned due to internal pressure while reporting on the Flutterwave money laundering investigation.

Despite Flutterwave’s attempts to bribe him to stop his reporting, Adonijah continued his investigative work.

He experienced increasing criticism, sidelining and rejection of his work by his editors, who eventually made it clear that reporting on the Flutterwave-ARA case was no longer a priority.

This pressure and the deliberate obstructions led him to resign from his position.

ARA ended its prosecution of Flutterwave in July 2023 after a year of intense negotiations.

Judge Nixon Sifuna furiously rejected the withdrawal and demanded an explanation for the mountain of evidence previously presented, showing Flutterwave’s engagement in money laundering.

Despite his outrage, Hon. Sifuna was limited in his role and ultimately had to agree to the case’s withdrawal, albeit with a scathing written judgment accusing ARA officials of bribery, racketeering and corruption.

“Today the suit is filed, tomorrow it is alive, and the next day it has been suffocated to death by its own initiator – the Agency,” he lamented.

He openly accused the ARA of cutting a deal for a share of the dirty money being laundered by Flutterwave and its associates in Kenya.

Justice Sifuna said the prosecution should be transparent in their actions and their motions should not be question-begging and inviting scrutiny.

The court wondered what happened to the volumes of documents that accompanied the suit when it was filed.

Judge Sifuna noted that when thet withdrawal file was taken to him, the agency and lawyers representing the firm requested the case to be mentioned in camera as there were ongoing negotiations.

He added that when the case was mentioned, the prosecution did not give reasons for the withdrawal but only stated that there was no evidence to sustain the case, hence no reason to ‘waste judicial time’.

Unsurprisingly, Fluterwave did not mention any of this in the cheerful press release they immediately sent out to newsrooms around the world announcing that the company had been “cleared of wrongdoing” in Kenya – something that categorically did not happen.

There's no story that cannot be told. We cover the stories that others don't want to be told, we bring you all the news you need. If you have tips, exposes or any story you need to be told bluntly and all queries write to us [email protected] also find us on Telegram