Kenyan investors have raised serious concerns about the safety and transparency of the NCBA Fixed Income Fund, also known as the NCBA Money Market Fund, following a viral social media post alleging unexplained and undocumented deductions from a customer’s account.

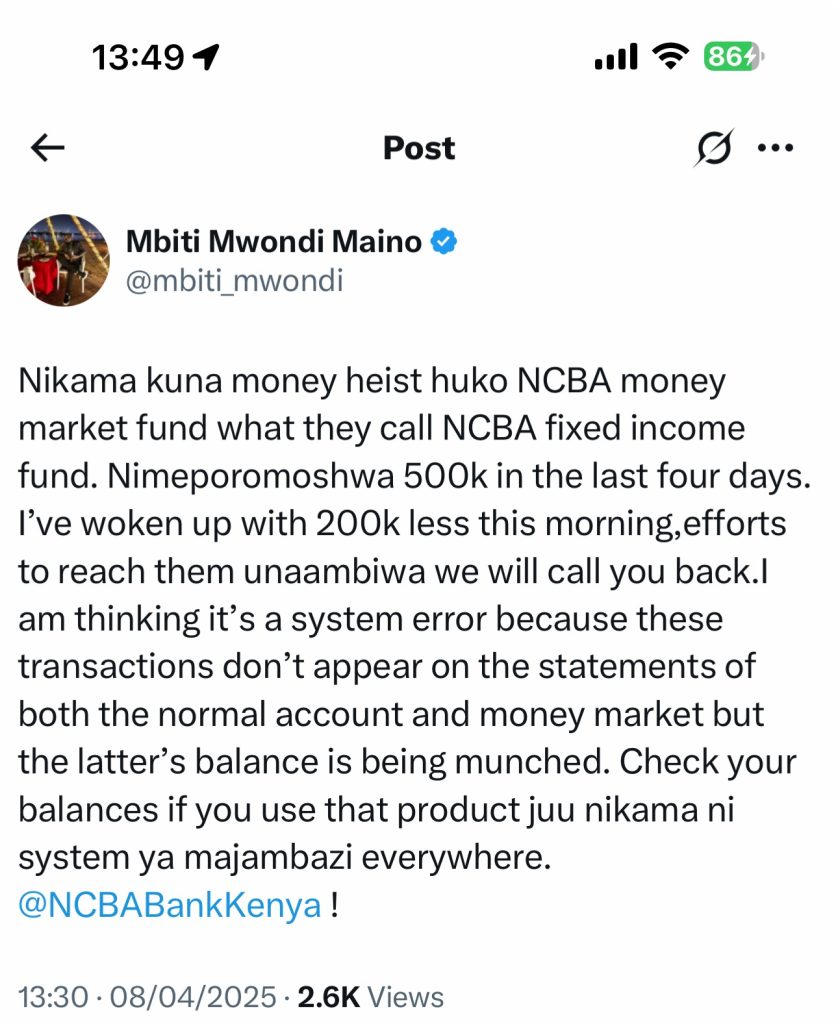

The alarm was sounded by prominent Twitter user Mbiti Mwondi Maino, who took to the platform on April 8th to express frustration over what he described as a potential “money heist” within the fund. In the strongly-worded post, Maino claimed he had lost KSh 500,000 over four days, with KSh 200,000 allegedly vanishing from his account overnight.

“Nikama kuna money heist huko NCBA money market fund what they call NCBA fixed income fund. Nimeporomoshwa 500k in the last four days,” he wrote, adding that efforts to reach the bank had been met with vague responses and promises of callbacks.

The post has since gained significant traction online, viewed over 2,600 times within hours, and has sparked a flurry of reactions from other users, some of whom report similar issues or express fears about their own funds.

According to Maino, the mysterious deductions do not appear in either his normal account statement or in the fund’s transaction logs, raising concerns about potential systemic errors or, worse, internal fraud. “The latter’s balance is being munched,” he warned, urging others to double-check their balances and suggesting a widespread issue: “nikama ni system ya majambazi everywhere.”

NCBA Bank Kenya has not yet issued an official public statement in response to the allegations. As of this publication, attempts to reach the bank for comment have been unsuccessful. The lack of prompt communication from the institution has further fueled speculation and frustration among customers.

The NCBA Fixed Income Fund, positioned as a low-risk investment vehicle offering steady returns, has grown in popularity among retail investors in recent years. However, this latest development could shake investor confidence if the issue is not swiftly addressed and transparently resolved.

Industry experts say that while system glitches in banking platforms are not unheard of, institutions must act quickly and clearly to reassure customers and prevent reputational damage.

For now, affected investors are advised to monitor their accounts closely and document any irregularities, while also seeking clarification directly from NCBA.

There's no story that cannot be told. We cover the stories that others don't want to be told, we bring you all the news you need. If you have tips, exposes or any story you need to be told bluntly and all queries write to us [email protected] also find us on Telegram