Nelson Amenya, a renowned Kenyan whistleblower, has recently exposed allegations involving KCB Bank and its purported role in laundering KES 69 billion from South Sudan through the accounts of EnglishPoint Marina.

These revelations have intensified scrutiny on the financial operations of both the bank and the luxury establishment.

EnglishPoint Marina, a prestigious property situated by Mombasa Harbour, comprises 96 apartments, eight penthouses, and a 26-room hotel.

The ownership includes Amin Kanji, his wife Leila, brother Alnoor, sister-in-law Nafisa, and director Nazir Jinnah.

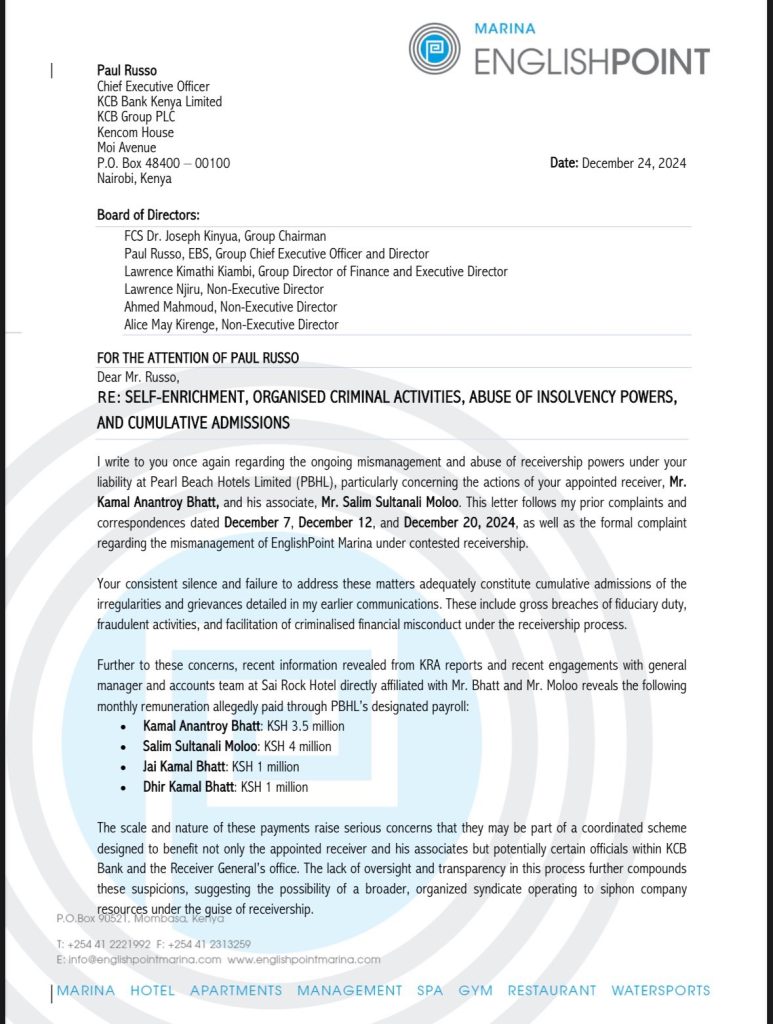

In June 2022, KCB Group seized the property, placing Pearl Beach Hotels, the owning real estate firm, under statutory management due to an outstanding debt of KES 5.2 billion.

Despite attempts to restructure the loan, the owners failed to meet their payment obligations, leading to the appointment of a receiver-manager to oversee the asset.

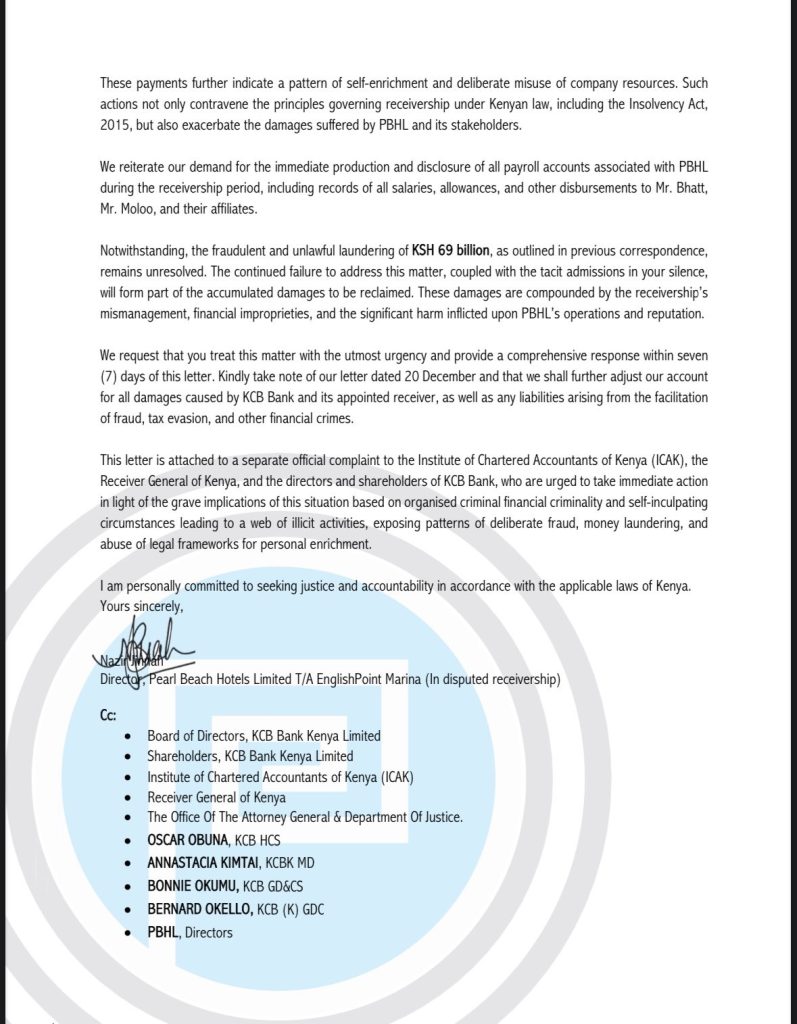

The situation took a dramatic turn when Nazir Jinnah accused KCB Group of laundering KES 69 billion from South Sudan through the hotel’s accounts.

These allegations, brought to public attention by Nelson Amenya, have prompted further investigations into the financial dealings of both the hotel and the bank.

Amenya, known for his commitment to transparency, has previously exposed controversial deals, including the Adani Group’s proposal to lease Nairobi’s Jomo Kenyatta International Airport, which sparked public outcry and a parliamentary investigation.

Further investigations have revealed that KCB Bank has been implicated in facilitating the siphoning of millions by South Sudanese political and military leaders during the country’s civil war.

Reports indicate that top officials exploited Kenya’s banking system, with KCB allegedly enabling large transactions without proper oversight.

For instance, Lt. Gen. Reuben Riak reportedly moved approximately USD 3.03 million through his personal U.S. dollar-denominated account at KCB between January 2012 and early 2016.

Such transactions have raised concerns about the bank’s role in enabling the flow of illicit funds.

In addition to the financial disputes, EnglishPoint Marina has faced legal challenges from apartment buyers.

A group of buyers sued the developer for denying them access to their apartments due to disputed service charge bills.

The buyers also claimed that management implemented strict rules that discriminated against certain homeowners, further straining relations between the developers and investors.

The complexities surrounding EnglishPoint Marina the intricate relationship between real estate development and financial institutions in Kenya.

The allegations brought forward by Nazir Jinnah, as highlighted by Nelson Amenya, have intensified overnight on the operations of both the hotel and KCB Group.

Nelson Amenya’s role in exposing these allegations highlights the critical importance of whistleblowers in promoting transparency and accountability.

His previous efforts, including uncovering the JKIA-Adani deal, have earned him recognition among the 100 Most Influential Africans of 2024.

Despite facing threats and legal challenges, Amenya remains steadfast in his commitment to advocating for good governance and ethical practices.

Apart from the one provided by Nelson Amenya KCB Bank has recently faced several massive scandals that have raised concerns about its governance and operational integrity.

In December 2024, under the leadership of Paul Russo, the bank was implicated in a fraud case involving Kencom Sacco, an organization primarily established for KCB staff.

The scandal centered around the unauthorized sale of shares worth Ksh 29 million, with the proceeds allegedly misappropriated by Sacco officials for personal use, including funding overseas education.

This incident exposed glaring weaknesses in the bank’s oversight mechanisms and highlighted the exploitation of investors associated with the institution.

In October 2024, KCB Bank was embroiled in another major controversy in Uganda, where it faced accusations of fraud and money laundering related to a $7 million loan extended to Tirupati Development (U) Limited.

The allegations included the creation of unauthorized bank accounts in the client’s name, through which substantial sums were transacted without the client’s knowledge, raising suspicions of money laundering activities.

This case not only questioned the bank’s ethical practices but also posed significant legal challenges across jurisdictions.

There's no story that cannot be told. We cover the stories that others don't want to be told, we bring you all the news you need. If you have tips, exposes or any story you need to be told bluntly and all queries write to us [email protected] also find us on Telegram