A three-year investigation by The Sentry into a loan deal between a local company and a regional bank with the backing of the South Sudan government has uncovered red flags for illicit business practices, including bribery, tax evasion, and trade-based money laundering.

The investigation found clear indications that the arrangement enabled powerful individuals to benefit from the manipulation of business worth hundreds of millions of dollars. The loan deal skirted legislation on oversight, transparency, and competition and facilitated off-book government spending, including supplies of fuel to the South Sudan army.

It also perpetuated a damaging reliance on future oil production to finance current spending, mortgaging the future prosperity of the country and its citizens.

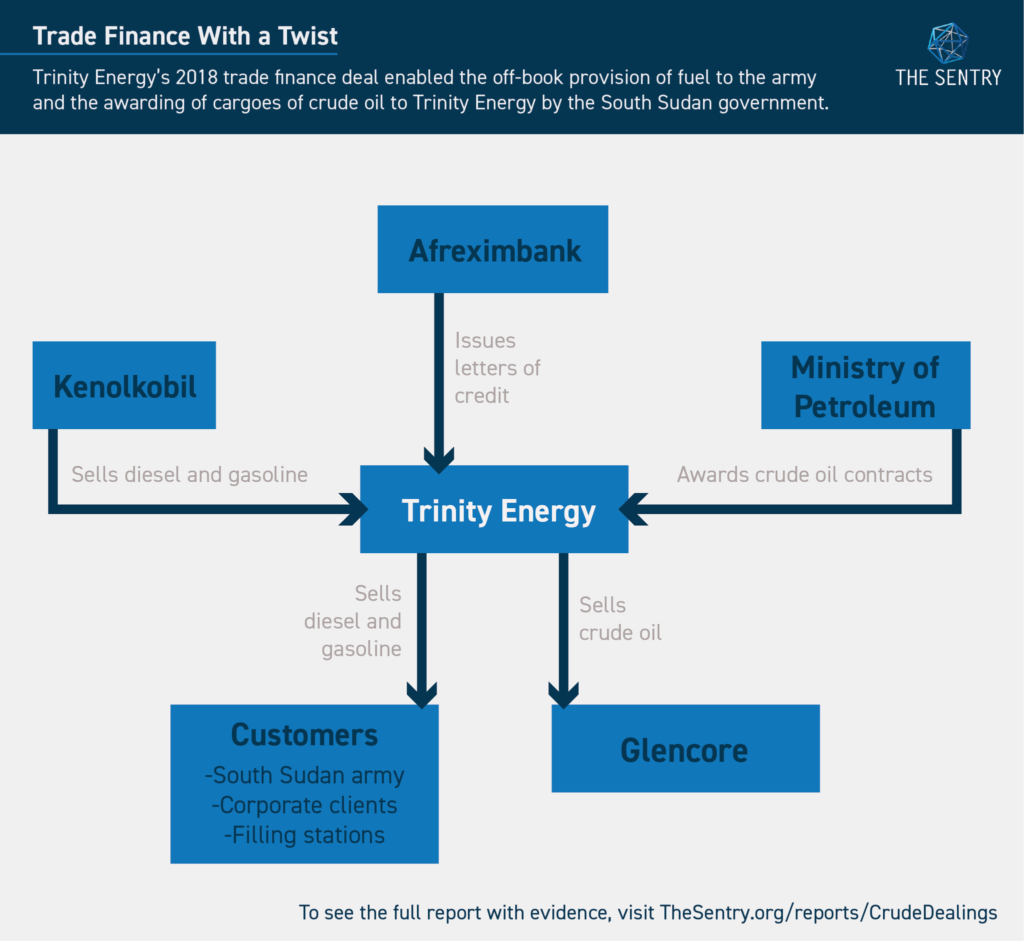

The imports deal included a series of $30 million loans to Trinity Energy for the purchase of diesel and gasoline to sell to the South Sudan market.

As part of the deal, the government of South Sudan committed to award cargoes of crude oil to Trinity Energy. The arrangement gave Trinity Energy privileged access to the market for South Sudan’s oil, the country’s most valuable resource.

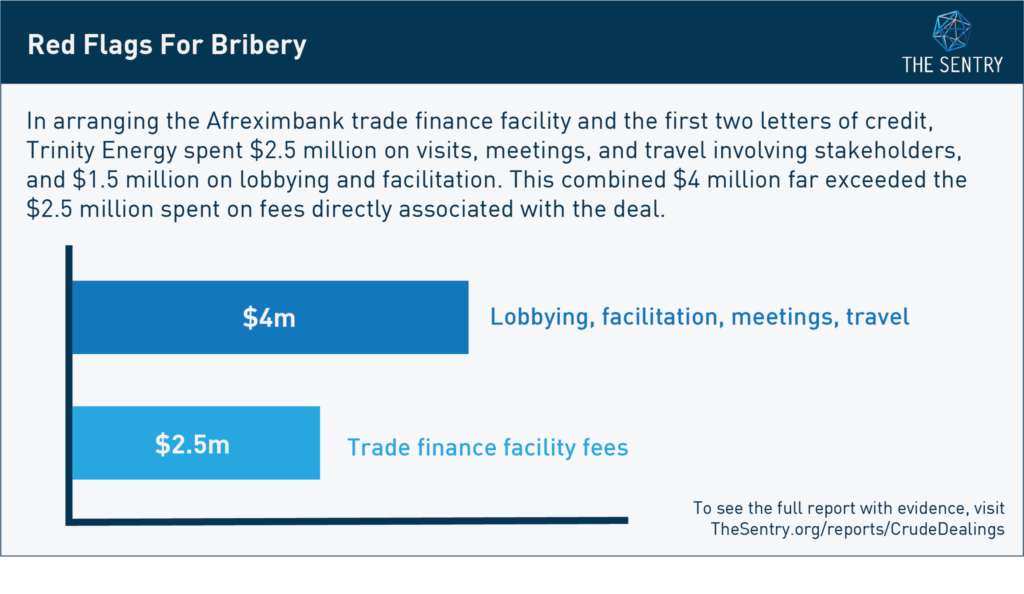

The Sentry interviewed a former Trinity Energy employee and reviewed the trade finance facility, bank statements, emails, internal memos, and ministerial correspondence. They found a laundry list of red flags for bribery, tax evasion, and trade-based money laundering.

The investigation found that Trinity Energy spent millions of dollars on “facilitation” and “business acquisition” costs for the deal, a red flag for bribery.

Another bribery red flag: The “business acquisition fees” included a 18.7 million SSP ($125,000) payment by Trinity Energy to members of the government’s Technical Loan Committee, the body responsible for approving the deal.

While implementing the trade finance deal, Trinity Energy changed millions of US dollars on the black market and paid fake invoices overseas to disguise the black market exchange of hundreds of thousands of dollars.

Trinity Energy wasn’t the only beneficiary of the loan deal. The deal also benefitted the government of South Sudan by taking a substantial amount of government spending off the books.

In an arrangement worth more than $1 million per month, Trinity Energy supplied fuel to the army at an inflated price. The deal, which was carefully kept away from public scrutiny, may have been designed to create surplus profits that could be shared.

While the trade finance deal was active, South Sudan’s government called on Trinity Energy for favors, including a $400,000 cash loan to cover expenses for an overseas mission by the First Vice President.

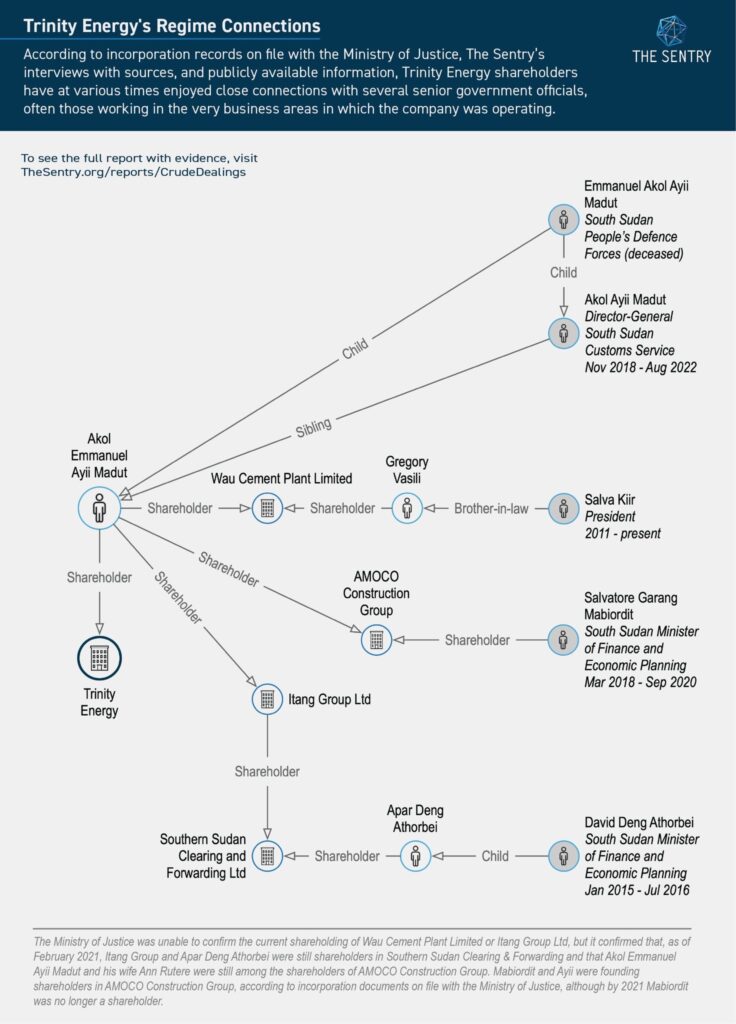

“Crude Dealings” also found that Trinity Energy’s shareholders and directors had ties to several politically exposed persons, often in the very areas where the company was operating.

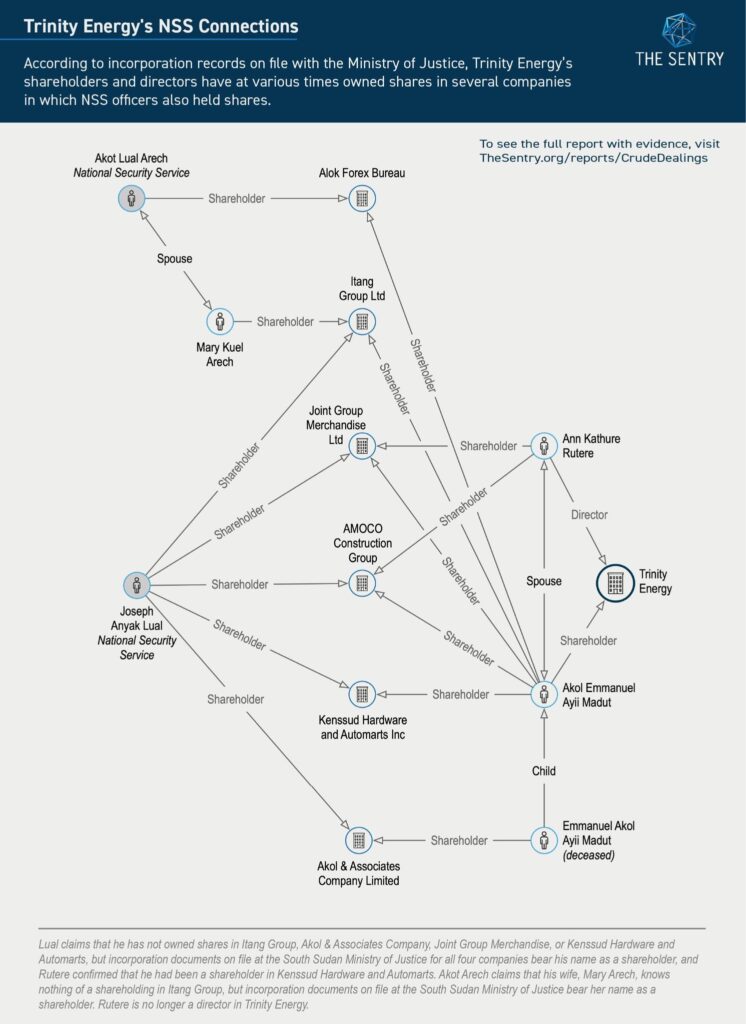

The connections didn’t stop with PEPs. Our investigation found several links b/w Trinity Energy shareholders and two officers in the National Security Service, while family connections may have played a role in facilitating Trinity’s business with the national army.

The report recommended that Kenya should investigate and prosecute illicit money flows. That the authorities should investigate the transactions identified in the report in which money sent to company accounts in Kenya raised red flags for trade-based money laundering.

It particularly singled out laundering Kenyan national Ann Kathure Rutere whom they want her finances investigated to ascertain whether any dubious or illegal payments or deposits have been made into her accounts.

Rutere was the Trinity Energy’s executive director at the time the deal was arranged and implemented. Other directors included Akol Emmanuel Ayii Madut and Richard Thadeus Raja.

Trinity Energy is 99% owned by Trinity Holdings, with 1% held by South Sudanese citizen Akol Emmanuel Ayii Madut. At the time the deal was arranged and implemented, Ayii had a 90% share in Trinity Holdings, with 10% owned by his wife, Kenyan citizen Ann Kathure Rutere. Rutere’s 10% stake was acquired by Indian national Richard Thadeus Raja in 2021. Ayii, Rutere, and Raja were the three directors of Trinity Energy at the time the deal was arranged and implemented,151 with Ayii in the position of chair and Rutere as executive director.

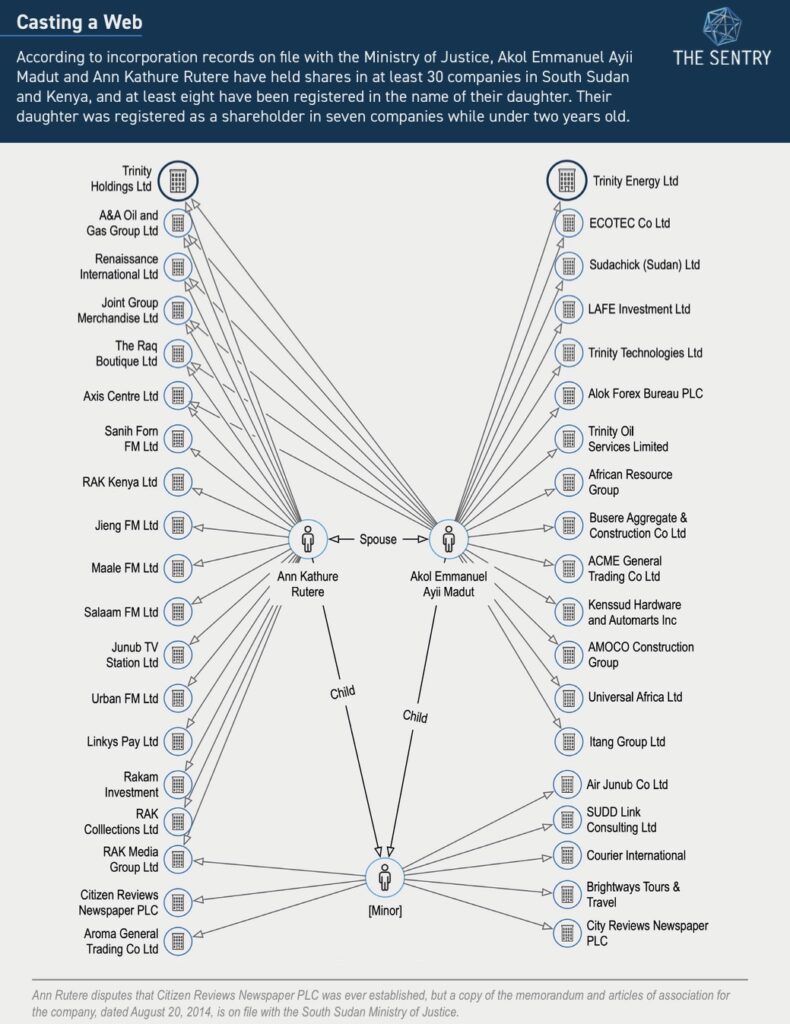

The large number of companies in which Ayii and Rutere have had shareholdings is a structural risk indicator for trade-based money laundering.861 The Sentry found that Ayii and Rutere have held shares in at least 30 companies in South Sudan and Kenya, and that at least eight have been registered in the name of their daughter. Their daughter was registered as a shareholder in seven companies in five of which she was named a director and in one a managing director while under two years old. According to Rutere, sev- eral of the companies set up by her and her husband have never operated, while others operated for a time and have since ceased to do business.

RAK Kenya

Between May 2 and June 28, 2018, Trinity Energy made payments totaling more than $70,000 to RAK Kenya, a Nairobi-based company in which Rutere owned a 90% share, according to bank statements reviewed by The Sentry. Related-party transactions such as these, in which one business or corporate group operates both the import and export ends of a trade transaction, can create opportunities for fraudu- lent trading and trade-based money laundering.

RAK Kenya, Rutere told The Sentry, was founded with a strategy of expanding the operations of RAK Media, another company in which Rutere owned a majority share, to Kenya “to reduce risk associated with doing business in South Sudan having suffered huge losses due to the 2013 war.”

According to Rutere, the mon- ey paid by Trinity Energy to RAK Kenya was “an intercompany loan to pay vendors in Kenya who supplied various goods used in our press business in South Sudan,”including “inks, papers and promotional materials.” This is contradicted by bank statements that show that money was transferred from three separate bank accounts at two different banks over a two-month period and that two of the transactions totaling $9,900 were dedicated to the “purchase of fuel.”

The labeling of these transactions as being for the purchase of fuel from RAK Kenya raises further ques- tions. Trinity Energy already had a deal in place with KenolKobil for the provision of the fuel imported by Trinity Energy to South Sudan, and, according to Kaswaswa, “it was only KenolKobil” that supplied fuel to Trinity. It is possible that RAK Kenya did not in fact supply fuel to Trinity Energy, which would raise red flags for trade misinvoicing. “All they are doing is moving funds from South Sudan,” said Kaswaswa, who contends that the directors of Trinity Energy “set up a number of companies in Kenya to transfer money to Kenya.” Rutere told The Sentry that she is a “law abiding citizen” who does not engage in “any illegal trade.”

Wayshire

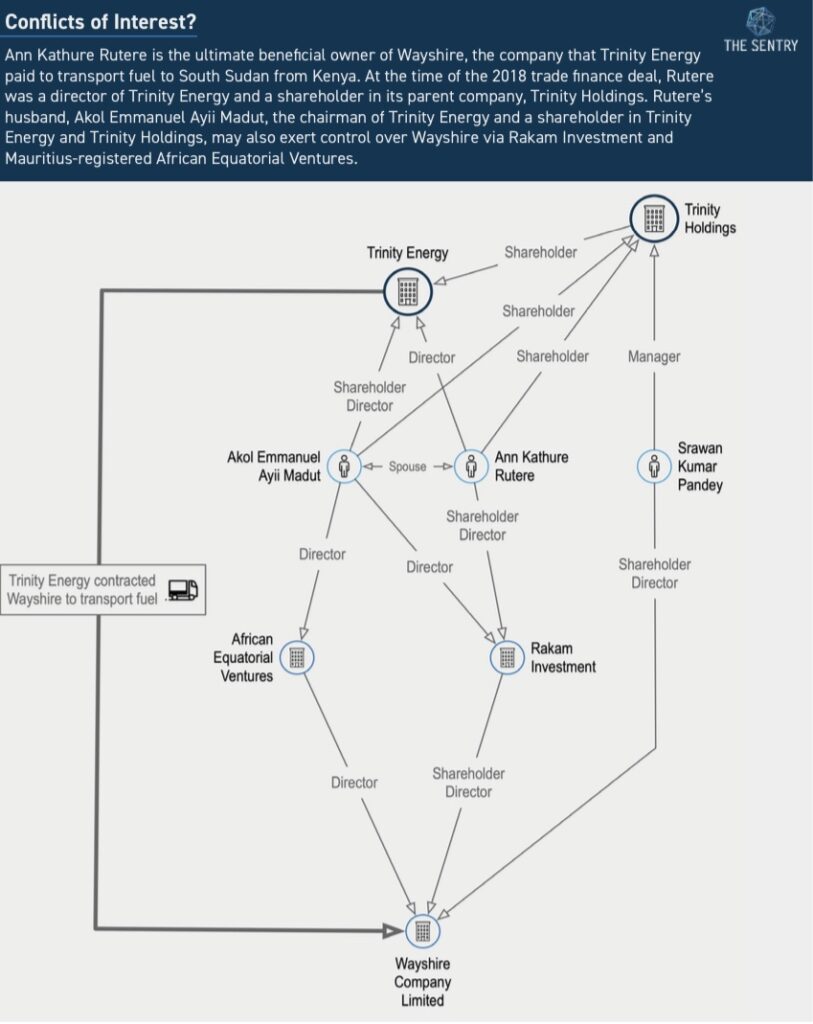

Trinity Energy made payments to at least one other Kenya-based company in which its directors had an interest. Wayshire Company Limited was responsible for transporting from Kenya to South Sudan the fuel that Trinity Energy purchased with LCs from Afreximbank. The agreement between Wayshire and Trinity Energy was signed on May 3, 2018, and renewed on May 13, 2020.

The majority shareholder in Wayshire is Rakam Investment, a company 100% owned by Rutere, mak- ing her the ultimate beneficial owner of Wayshire. Ayii and Rutere are listed as the sole directors of Rakam Investment, meaning that they jointly control Wayshire. Rutere is also a director of Wayshire. The Sentry also found indications that Ayii may exert control over Wayshire through a Mauritius registered com- pany, African Equatorial Ventures. Ayii is a director of African Equatorial Ventures, which in turn is a reg- istered director of Wayshire. The opaque nature of company records in Mauritius means that The Sentry was not able to rule out the possibility that Ayii is also a shareholder in African Equatorial Ventures. Srawan Kumar Pandey, group finance manager for Trinity Holdings, is also among Wayshire’s shareholders.

The involvement of Rutere and Ayii in both Trinity Energy and Wayshire makes the deal for Wayshire to transport fuel for Trinity Energy vulnerable to transfer pricing. Such transactions open the door to fraud, trade-based money laundering, and possible breaches of the arm’s length principle. Rutere contends that Wayshire was “not privy to the agreement between Trinity Energy and Afreximbank” and that “the arm’s length principle was maintained during all contractual negotiations and transactions” between Wayshire and Trinity Energy, although she also claims to have not been involved in the operational details of Trinity En- ergy’s Afreximbank agreement. “Any transaction from May 2018 onwards I was busy handing over and preparing new CEO for his duties and role,” said Rutere.

The registration of African Equatorial Ventures in Mauritius is in itself concerning. Mauritius offers low individual and corporate tax rates and allows companies to avoid paying capital gains tax. This is not illegal, but the impact can be damaging.

A sophisticated financial system on the island “is designed to divert tax revenue from poor nations back to the coffers of Western corporations and African oligarchs,” found an investigation by the International Consortium of Investigative Journalists. Mauritius is one of the most complicit jurisdictions in the world in helping multinational corporations underpay corporate income tax, ac- cording to an index compiled by UK-based Tax Justice Network.

The taxation benefits offered by Mauritius have for decades made it attractive to shell corporations companies that don’t have active business operations or significant assets in their country of registration. The Sentry found indications that African Equatorial Ventures may be a shell corporation. Not only is it registered in Mauritius, a country in which the company’s directors have no apparent reason to do business, but it also does not have a web page, and its physical address is listed as care of another company, Ocorian Corpo- rate Services. Ocorian is listed in corporate registry documents as the “management company” and “secretary” for African Equatorial Ventures. In May 2018, Trinity Energy made two payments of $9,500 to Ocorian, then known as Abax Corporate Services, from two separate bank accounts, according to bank statements reviewed by The Sentry. One of the payments was to an account with Abu Dhabi Islamic Bank in the United Arab Emirates. The fact that payments were made by Trinity Energy to Ocorian a company acting on behalf of a company that is a director of the company that is transporting fuel products to Trinity seems convoluted and also suggests a potential conflict of interest.

RAK Media

Between May 8 and September 4, 2018, Trinity Energy made five bank transfers worth a total of more than $140,000 to RAK Media, a printing and advertising company registered in South Sudan that was founded by Rutere and Ayii and in which their then-four-year-old daughter held a 40% share. The transfers are all consistent with risk indicators for trade-based money laundering highlighted by the FATF and the Egmont Group, being payments “sent or received in large round amounts for trade in sectors where this is deemed as unusual.” The three payments made in US dollars from Trinity Energy to RAK Media were all round thousands, including one for exactly $100,000. The two South Sudanese pound payments were for precisely 1 million SSP and 2.5 million SSP.

The sums of money transferred by Trinity Energy were not consistent with the value of services delivered by RAK Media, according to former Trinity Energy finance manager Kaswaswa. The company “did not spend more than $300 per month on advertising,” Kaswaswa told The Sentry. The main printing cost, he said, was to produce coupons used by gas filling station customers.

There's no story that cannot be told. We cover the stories that others don't want to be told, we bring you all the news you need. If you have tips, exposes or any story you need to be told bluntly and all queries write to us [email protected] also find us on Telegram