The deal was simple as it was straightforward: get us an investor for our real estate properties and we will pay a fee at the rate of two per cent of the contract sum.

Yet this rather simple and straightforward deal has now become a contentious case of alleged double-crossing and backstabbing as Centum Development Investment Kenya Ltd (CDKL) and financial consultancy firm, Raisin Limited, battle over hundreds of millions in commission.

After introducing Global Emerging Markets to CDKL, the contract that was eventually signed was with Centum Real Estate Limited and not CDKL. On this basis, CDKL says they have not signed any contract with an investor introduced to them by Raisin Limited and therefore the Sh340 million the latter is demanding is a mistake.

Raisin on the other hand accuses CDKL of double-crossing it by taking the investor to sign a contract with one of its partner companies and using that to deny it the Sh340 million in commission.

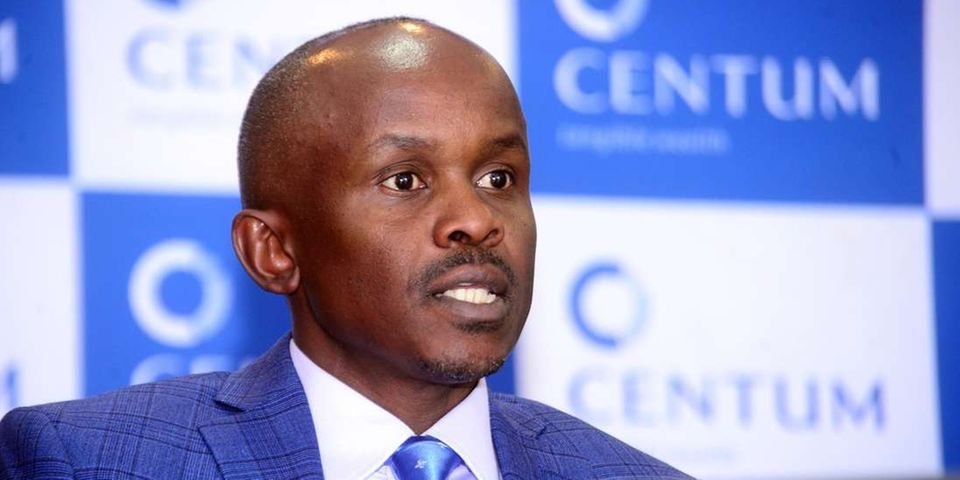

While it initially started as a business deal gone sour, a threat by Raisin Limited to sue Centum Investment CEO James Mworia for defamation has also muddied the waters as the two firms go after each other over Sh340 million fees.

Centum Investment Ltd is the parent company of CDKL and after reports of the dispute between the two companies emerged, Mr Mworia was reported to have referred to Raisin Ltd as “someone trying to extort Centum using the media” and “an impostor.”

“By publishing the statement to the effect that our client is an imposter trying to extort Centum Group you portray our client as a criminal, corrupt, dishonest and fraudulent.

The scandalous and scurrilous use of the phrase ‘imposter and extortion’ in relation to our client was actuated by ill-will and malice towards our client,” Raisin’s lawyer Dennis Mosota wrote to Mr Mworia on January 28.

The letter further states: “The dominant and premeditated motive inferred from your statement was to disparage our client before right-thinking members of society, particularly its affiliates and business partners.

The aggregate conduct and actions attributed to the esteemed person and character of our client in the said publication are callous as a highly acclaimed company whose reputation in financial advisory services spans

globally.”

The real bone of contention is, however, over the Sh340 million Raisin Ltd was supposed to be paid as a finder’s fee for linking up CDKL to an investor, Global Emerging Markets, for the Centum’s real estate holdings. The agreement was that Raisin would get a two per cent commission of all the funds raised if they sourced for an investor.

“In the event that the company enters into an agreement with an investor introduced by the consultant during the term of this agreement or within six months after the expiration of the term of this agreement the company shall pay to the consultant sum equal to two per cent of the funds raised. The funds raised shall be the contract price as shown on the agreement between the company and the investor,” the Finder’s Fee Agreement between CDKL and Raisin signed on June 17, 2021 states.

According to a demand letter by Raisin through lawyer Mosota, the consultant sourced for Global Emerging Markets, a private equity firm, which was investing Sh17 billion in the Centum Real Estate Ltd.

However, after Raisin introduced the investor to CDKL, the latter sought to bypass the terms of the agreement and instead of signing the deal with Global Emerging Markets, it brought on board Centum Real Estate Limited to instead execute the contract.

“In blatant breach [of] Clause 7 of the Agreement your company through its sole shareholder (Centum Real Estate Limited) and directors, circumvented the terms of the agreement and commenced negotiations with Global Emerging Markets leading to an execution of an investment agreement of Sh17 billion between Global Yield LLC CSC, a fund under Global Emerging Markets, and Centum Real Estate Ltd.

From the foregoing, the investment by the private equity firm emerged from the introduction by our client (Raisin), in fulfilment of its obligations under the agreement,” the letter states.

However, while acknowledging that Raisin had an agreement with CDKL, Centum’s lawyer Andrew Musangi says that Raisin is a stranger to Centum Real Estate Limited.

“It is clear on the face of the documentation that Raisin Limited contracted with Centum Development Investment Kenya Ltd (CDKL) as a non-exclusive consultant.

There is no privity of contract with any other company at all,” Mr Musangi responded to Raisin’s demand letter.

According to Mr Musangi, CDKL has not signed any contract with an investor introduced to them by Raisin.

“In the circumstances, your client has addressed its demand notice to parties that it is a stranger to. Your client will be put to strict proof of each and every one of its allegations,” the Centum response states.

Centum Real Estate is currently developing over 1,400 homes and has another 3,000 units in the pipeline. GEM meanwhile has an asset base of $3.4 billion (Sh384.9 billion) and has operations in Paris, New York and the Bahamas from which it manages a variety of investment vehicles.

The investor is expected to provide Centum Real Estate with a share subscription facility of up to Sh17 billion for a 36-month term following a public listing of the shares.

“The share subscription facility will allow Centum Real Estate to draw down funds by issuing shares of common stock to GEM. Centum Real Estate will control the timing and the maximum size of such drawdowns and has no minimum drawdown obligation,” the firm said in a statement.

GEM is expected to assure the partial uptake of the shares subscription in what is seen as a move by Centum to firm up its new capital raising strategy.

There's no story that cannot be told. We cover the stories that others don't want to be told, we bring you all the news you need. If you have tips, exposes or any story you need to be told bluntly and all queries write to us [email protected] also find us on Telegram