After fleeing for their lives, two Kinshasa auditors at Afriland Bank leak thousands of documents showing its ties to sanctioned businessman Dan Gertler

Two auditors, who fled Congo-Kinshasa in fear of their lives, have leaked thousands of bank records showing how companies linked to Israeli business magnate Dan Gertlerwere able to bypass sanctions imposed on him by the United States in December 2017. The US Treasury had accused Gertler of amassing his fortune ‘through hundreds of millions of dollars’ worth of opaque and corrupt mining and oil deals’ in Congo-Kinshasa.

The leaked records, which document an elaborate system of alleged money-laundering centred on Afriland First Bank’s branch in Kinshasa, are being made public by the campaign group the Platform for the Protection of Whistleblowers in Africa (PPLAAF) and media outlets, including Africa Confidential. The revelations come a month after it emerged that Gertler had negotiated an unprecedented licence from officials in the outgoing Donald Trump administration suspending the sanctions for a year.

The move prompted three Democrat lawmakers – including the Chair of the House Committee of Foreign Affairs – to write a 3 February letter to Treasury Secretary Janet Yellen, saying the waiver ‘upends US policy’ towards Congo-Kinshasa and calling for it to be reversed. These concerns are being raised as President Félix Tshisekedi appears to have wrested control of the National Assembly in Kinshasa away from his predecessor Joseph Kabila, a close business ally of Gertler’s (AC Vol 62 No 3, Félix tips the scales).

The Treasury department is currently reviewing the circumstances that led to the issuance of the special licence to Gertler. Scrutiny of the documents on the company accounts at Afriland First Bank, one of Central Africa’s largest financial groups, and these latest allegations of money-laundering made against Gertler’s companies, are likely to form part of the review of his case in Washington DC.

The two whistleblowers, Gradi Koko Lobanga and Navy Malela, were both working as in-house auditors for Afriland in Kinshasa. They told Africa Confidential their attempts to raise concerns about evidence of money-laundering at Afriland First Bank’s Kinshasa office were met with obfuscation, and then the threat of violence, prompting their flight to Europe.

Their fears look well-founded. On 25 February, representatives for Gertler and Afriland told journalists that a court in Kinshasa had convicted the whistleblowers for ‘criminal conspiracy’ and sentenced them to death. The sentence is said to have been handed down in September, but Gertler and Afriland are only talking about it now.

Gertler’s lawyers have used the verdict as vindication for their cause, with the United Kingdom‘s Carter-Ruck telling Africa Confidential that Koko Lobanga and Malela ‘have been convicted for having stolen, modified and forged the extracts of the clients of the bank’. Gertler also said, through representatives, that ‘the judgment has also condemned Mr Malala and Mr Koko to death’.

‘The sad position now is that Mr Malala and Mr Koko cannot return to their homes in the DRC, including being unable to visit their families and friends and, unless the death penalty can be overturned, they must live under the threat of this,’ Gertler said, blaming Western NGOs and advocacy groups for their plight. ‘They have been very foolish to co-operate with and assist Global Witness and PPLAAF, but they do not deserve such a draconian sentence,’ he said.

PPLAAF told Africa Confidential that it thinks ‘this judgment is false’, and that its lawyer in Kinshasa had sought out the judgment at the law courts and ‘could not find any trace’ of it. ‘There is a moratorium on the death penalty in DRC [Congo-Kinshasa]. Such a sentence would be a stain on the record of President Tshisekedi,’ PPLAAF added.

Koko Lobanga and Malela worked with PPLAAF as part of the organisation’s long-running investigation into the theft of state assets and revenues in Congo-K. With PLAAF, they shared the bank documents with a consortium of investigative journalists including: Ha’aretz, Bloomberg News, Radio France Internationale (RFI), Radio Télévision Suisse (RTS), Congo-Kinshasa’s actualité.cd and Africa Confidential.

The documents show the lengths that Gertler’s business network went to in order to avoid falling foul of US anti-money-laundering restrictions and banks’ compliance departments. A previously unknown company that ‘Big Four’ audit firm PricewaterhouseCoopers (PwC) has said was ‘largely tied’ to Gertler received around a quarter of the Afriland branch’s entire loans in early 2019, and several companies tied to alleged financiers of Hezbollah and North Korea‘s armaments programme also held accounts at the branch, the evidence shows.

‘It’s a wake-up call,’ said Koko Lobanga, who was Head of Internal Audits at Afriland in Kinshasa before fleeing the country in 2018. ‘The authorities who are supposed to have oversight over any of these activities must be sanctioned.’

‘At the beginning it was a professional duty,’ said Malela of his attempts to raise money-laundering concerns at Afriland, which is headquartered in Cameroon and whose holding company is in Switzerland. ‘But gradually we understood that our combat went beyond this… We could not be complicit in the plundering of our country.’

The whistleblowers said they became concerned about transactions at Afriland in early 2018, soon after the US imposed sanctions on Gertler and his companies in December 2017.

Gertler strongly rejects all accusations of corruption and sanctions violations. There is ‘no truth in your claims about the methods allegedly used’, London law firm Carter-Ruck said on behalf of Gertler.

In comments to RFI, Afriland Deputy General Manager Patrick Kafindo said high levels of cash deposits were normal. In Congo-Kinshasa, people ‘prefer that you give them cash. That’s how people have been living,’ he said.

Malela said that he witnessed Gertler visiting the bank in early 2018, alone at first, and then in the company of his associate Alain Mukonda, who had re-domiciled many of Gertler’s companies from Gibraltar and the British Virgin Islands to Congo-Kinshasa after US sanctions were imposed. Mukonda and another man linked to Gertler, his family friend Shlomo Abihassira, both regularly made huge cash payments into the bank, said Koko Lobanga.

The cash was packed into briefcases and handled at the offices of senior management on the second floor, rather than at the cashiers downstairs like other customers, said Malela. After watching the waltz of businessmen, briefcases and cashiers in and out of the senior managers’ offices, he could immediately see the substantial deposits ping on the Gertler-connected accounts.

Mukonda paid €11 million in 16 deposits into the bank accounts of Gertler’s companies during the six months following the imposition of sanctions, the Afriland records show. Abihassira, who resides in Israel, paid US$19m into a company he set up in Congo-Kinshasa over roughly the same period, also entirely in cash, with $6m once being deposited in a single day. Last year, after a first round of revelations, Mukonda told PLAAF and Global Witness that he wasn’t working with Gertler, and Abihassira denied any wrongdoing in his business operations. Carter-Ruck said that the claimed network of Gertler proxies at Afriland ‘does not exist’.

Koko Lobanga says he raised his concerns in February 2018 about money-laundering with Kafindo, the Afriland Deputy General Manager, and asked to examine the records for specific accounts, including for Abihassira and one of Gertler’s main companies, Ventora Development.

Worried, Koko Lobanga wrote a letter to Afriland’s Kinshasa management, saying that ‘irregularities have been detected on Mr Dan Gertler‘s accounts’ and that ‘these irregularities are capable of exposing the bank to risks of non-conformity on the national or international level’. He recommended ‘a thorough audit’, and that the accounts for Ventora Development and others linked to Gertler be frozen. Ventora is the recipient of tens of millions of euros in copper and cobalt royalty payments from the international commodities giant Glencore.

Within days of sending the letter, Koko Lobanga clashed with Kafindo at the Kinshasa office. ‘He clearly threatened me, saying that somebody could shoot at me as I was leaving the bank.’ Fearing for his safety, Koko Lobanga fled to Europe in March 2018. Kafindo did not reply to questions from Africa Confidential.

Malela stayed at the bank after Koko Lobanga’s departure, making it his mission to unpick the transactions by companies connected to Gertler. ‘I began to extract all the information I could get,’ said Malela, adding that he sent the documents to a senior Afriland executive in charge of audits for the banking group across Africa.

This led nowhere, but he was simultaneously sending the documents to Koko Lobanga with the aim of ‘blowing the whistle’. Eventually, Malela was moved from the audit department and, fearing for his security too, he left Congo-Kinshasa in February 2020.

Both Malela and Koko Lobanga were helped by PPLAAF in Europe, where they now live with their families, and fought off subsequent legal threats from Afriland.

‘The story of Koko Lobanga and Malela is once again the one of courageous Congolese who decided to blow the whistle on deeds that went against their countries’ interest,’ said Gabriel Bourdon of PPLAAF. ‘Unfortunately, once again it is a story where a person who does the right thing has to face threats and exile. PPLAAF is proud to have been protecting Koko and Malela to the best of its ability from threats of reprisals and the obstacles of life in exile.’

Despite Koko Lobanga and Malela’s concerns, the audit by PwC of Afriland’s Kinshasa branch for 2018 said its finances were ‘in conformity with accounting principles generally accepted in the Democratic Republic of Congo’.

PwC, which did not consult with the compliance officers when conducting its audit, told Africa Confidential on 26 February that its reports were presented to Afriland’s local management in Kinshasa and ‘… in addition any concerns were raised with the relevant regulatory authorities including the central bank of the Democratic Republic of Congo.’

It added that as statutory auditors it was ‘bound by issues of client confidentiality and cannot publicly comment on the operations of the bank.’

Gertler and Afriland have spared no effort in their counter-attack. Africa Confidential reported last August on a smear campaign led by Gertler, that relied on manipulated videos and recordings of journalists and French lawyer William Bourdon, the founder of PPLAAF (AC Vol 61 No 16, Fury greets Gertler report).

The evidence of Afriland’s willingness to offer banking services to a motley crew of international pariahs will make uncomfortable reading at Congo-K’s Central Bank. The country’s highly dollarised economy cannot afford to attract the ire of American regulators, following earlier exposés of sanctions-busting by the Congo-K branch of Gabon‘s BGFI bank (again, hotly denied by the bank itself). If it did, banks in New York may decline to process dollar transactions for Congolese banks for fear of falling foul of US sanctions laws.

REVOLVING DOORS IN KINSHASA

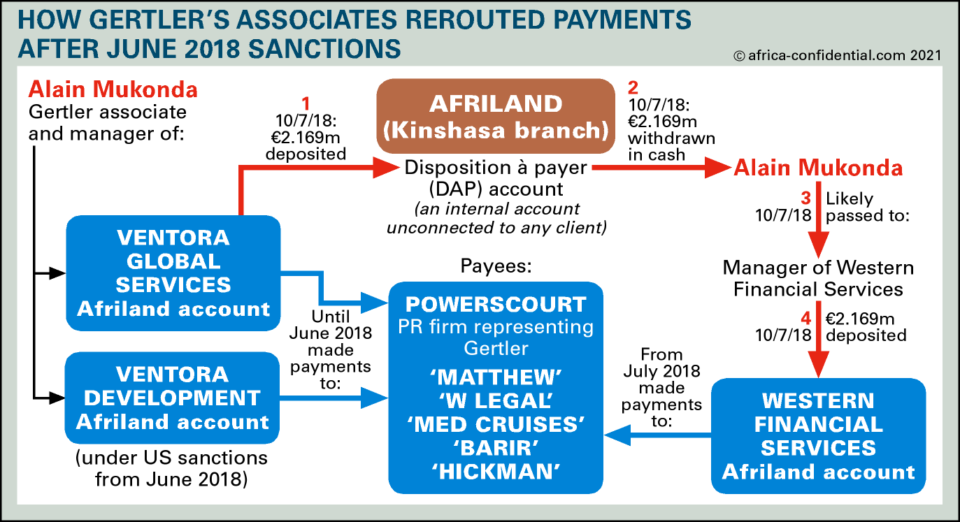

The documents collected by Navy Malela, one of the in-house auditorsofficers at Afriland First Bank in Kinshasa, show how a special intermediary account at the bank that was not tied to any individual – called the disposition à payer (DAP) account – allowed companies in Dan Gertler‘s network to convert many millions of US dollar banknotes into euros.

The euros were then moved into accounts run by associates of Gertler, or members of his immediate family.

‘The DAP is a legitimate account to manage clients’ money,’ said Malela. ‘But it was used for criminal ends, with the aim of laundering money.’

These methods appear designed to get around United Statessanctions, which prohibited Gertler from conducting bank wire transactions in dollars. The use of front companies could also allow him to avoid compliance officers at other banks, who can block transactions over corruption risks.

Mukonda was a key figure using the intermediary DAP account in Kinshasa. According to documents reviewed by Africa Confidential, on 18 January 2018, Mukonda deposited US$500,000 into the DAP account at Afriland’s Kinshasa branch, and immediately withdrew the equivalent in euros (€403,225). He then deposited the funds into the account of Ventora Development, the bank records show.

It was the start of a repeated pattern, and one employed not only by Mukonda. On the same day that he was turning $500,000 into euros, another $500,000 cash deposit is recorded at the bank, attributed only to a ‘Mr Julien’, which was subsequently withdrawn as €403,225. ‘Mr Julien’ then deposited these funds into the bank account of Gertler’s wife, Anat. Dan Gertler said, through his lawyers Carter-Ruck, that neither he nor his wife ‘recall any such deposit into Mrs Gertler’s account’.

Over six months, from January to July 2018, Mukonda made deposits of $10.5m and €3.5m of cash into the DAP account, and withdrew $7.1m and €6.3m. Mukonda has denied operating on behalf of Gertler, yet he is listed as the ‘president’ of Ventora Development and personally handled the re-domiciling of several of Gertler’s companies to Congo-K after the imposition of sanctions.

Tracing the money leads to a new company that seems to be operating on behalf of Mr Gertler. Mukonda’s final euro withdrawal in the records reviewed by Africa Confidentialcame on 10 July 2018, when he took €2.169m from the Kinshasa DAP account. Records indicate that this money arrived in the DAP account from Ventora Global Services, another Gertler-linked company at which Mukonda was manager. On the same day, the exact same amount was deposited, in cash and in euros, into the account of Western Financial Services (WFS) by Zenon Mukuku, the bank records show. This is the very first transaction visible in WFS’s Afriland records.

WFS was established just days earlier, on 4 July 2018, and is run by Mukuku, according to records on Congo-Kinshasa’s commercial register. Mukuku was previously named as a representative of another sanctioned Gertler company, Orama Properties, in a 2014 report by the Congolese chapter of the Extractive Industries Transparency Initiative.

Gertler’s lawyers told Africa Confidential that the banking documents were falsified and that he had not carried out the cash transactions described above, adding that Mukonda had never even set foot in Afriland. Gertler’s lawyers said that Mukuku ‘provides services to companies of’ Gertler, but claimed Gertler has no ties to WFS.

WFS’s records for 2018 to 2019 show it making payments to consultants, lawyers and others who are known to provide services to Gertler, including the London-based PR firm Powerscourt, which has represented him for several years. Prior to June 2018, when the US sanctioned Ventora Development, several of these payees had been paid by the two Ventora companies. WFS did not seem to be engaged in any obvious business activity, from its account records. For the most part, its income depended on sporadic, hefty cash deposits made by Mukuku, and loans from Afriland.

Afriland’s lines of credit to WFS were remarkably large. In late September 2018, Afriland loaned WFS €17m, which was almost immediately returned to the bank. On 11 October 2018 another €16.5m was loaned to WFS. Seemingly unable to service its debt with its own income, in late December 2018 WFS borrowed a further €28.5m from Afriland, using part of those funds to pay off the €16.5m loan. The pattern repeats on 7 March 2019, when a €39.5m loan was partly used to pay off the €28.5m debt. The records end that month.

APwC audit shows that the €28.5m represented 16.75% of Afriland’s total client loans as of end-2018, and the €39.5m credit accounted for some 23% of the total loans figure. The audit did note that Afriland made a €28.5m loan ‘to a company that is largely tied to another company under sanctions’ but said that this did not affect its overall conclusions that the accounts were in good order.

AFRILAND’S AXIS

As well as the companies linked to Israeli magnate Dan Gertler, Afriland had several other controversial clients. The leaked records show that several companies with ties to alleged funders of Hezbollah, the Lebanese Shia militant group,held accounts at the bank. These include: Cotrefor, Industrie Forestière du Congo (Ifco), Kin Trading, Congo Best Foods and Minoterie du Congo (Minocongo).

Major Congo-Kinshasa logging companies Cotrefor and Ifco, as well as Kin Trading, are reportedly closely tied to the Congo Futur group, a conglomerate that has been under United States sanctions since 2010 for being part of a network providing millions of dollars to Hezbollah. Congo Best Foods and Minocongo were put under sanctions in 2019, later than the data provided by the whistleblowers. The US Treasury said they were controlled by Saleh Assi, accused of providing funds ‘to a US-designated Hezbollah financier’.

Afriland did not respond to questions from Africa Confidential about these clients’ alleged links to Hezbollah.

The banking records show that on one day the boss of Ifco – one of the companies with alleged Hezbollah ties – withdrew dollars from the Kinshasa DAP account just before Gertler’s right-hand man Pieter Deboutte came by to collect US$128,700 in cash.

Two North Korean companies that make statues also had accounts with Afriland: Mansudae Overseas Project Architectural & Technical Services, and Congo Aconde. Mansudae, which specialised in gigantic bronze monuments, was put under US sanctions in 2016, on the basis that its revenues could have been ultimately used to fund North Korea’s nuclear programme. It has also been involved in military construction projects in Namibia.

Congo Aconde was set up in 2018 and built monuments in Congo-Kinshasa, including one of former President Laurent Kabila (Joseph Kabila‘s father). US campaign group The Sentry, which revealed Afriland’s ties to the North Korean companies last year, said Congo Aconde’s contracts ‘appear to violate sanctions adopted by the European Union (EU), the United Nations, and the United States’. UN sanctions specifically prohibit countries from procuring statues from North Korea.

The UN panel of experts monitoring sanctions against North Korea recommended sanctions against the two men who set up Congo Aconde, Pak Hwa Song and Hwang Kil Su, who also bank at Afriland.

Afriland Deputy General Manager Patrick Kafindo told Radio France Internationale that the North Koreans in question were not sanctioned when they opened accounts and said he would not refuse their business based on their nationality. ‘When a North Korean wins a deal with the state, do I have to deny him opening an account because he is North Korean?’ he said.

There's no story that cannot be told. We cover the stories that others don't want to be told, we bring you all the news you need. If you have tips, exposes or any story you need to be told bluntly and all queries write to us [email protected] also find us on Telegram